We conducted channel checks across various segments of TV/digital to gauge near term business prospects and impact of Sony/Zee merger if it goes through; enclosed below are some snippets from our conference

Snippets from our channel check series (TV industry and Zee/Sony Merger) and our view

Synergies for Zee/Sony on TV/digital business and cultural impact

ZEE/Sony are strong on TV with synergies; digital business lags due to high competitive intensity from aggregators and Hotstar. Advertising synergies too exist as both have a different TG (target group) on TV and digital side. Zee has a woman centric TG whereas Sony has an urban centric TG. In case of the Sony/Zee merger going through, there will be a big shift in the culture as Sony, Japan may hive off a large chunk of Zee employees on TV and OTT; we believe this too may be a risk and further extend the transition period for new management, as they may not be able to manage Zee as efficiently (Zee has the best EBITDA margins in TV business today despite owning IP in content). It was also learnt that Sony will go ahead with the merger deal with Zee, even if Mr. Punit Goenka is removed as CEO/MD of the company by Invesco and other shareholders.

Future of OTT in India and growth prospects

Very important to invest in tech and user experience offerings to scale up OTT offering; overall video advertising (market size of ~INR 6,000cr in India) will continue to grow faster vs overall digital market and will be dominated by aggregators and sports led OTT’s. Short form videos is an innovative way for brands who want to chase audience in tier-2 and tier-3 markets; OTT companies must innovate around this. SVOD (market size of ~3,000cr in India) will continue to grow much faster vs AVOD on digital media and will also cannibalise AVOD to some extent for some players; number of smart TV’s today are almost 30mn in India and this is expected to triple towards 100mn over the next 3-5 years

TV business prospects over medium term

Overall, TV advertising remains strong and is expected to grow by 6%-8%YoY during the OND (Oct-Dec’21) quarter helped by festive seasons; dependence on FMCG has reduced as internet companies spend big money advertising. Local advertising too has seen some green shoots in recent past. Regional genre will be the only growth driver for TV segment with low double digit growth; mainstream Hindi fiction will grow in line with industry averages (mid-single digit growth) and fresh content investments too have dried down in the same. Big interest visible in sports beyond cricket which is a promising sign, however the Cost per impression remains higher for other sports despite extremely low pricing; cricket advertising on TV won’t grow too much, however on digital it will outperform vs digital ad. growth (25%-30% market avg. growth) by a big margin

TV distribution impact due to NTO 2.0 and transition to digital

Revenue contribution from ala carte (currently at 6%-7%) will see a sharp rise towards ~15% post the implementation of NTO 2.0, however this may not have any negative impact on ARPU. Chord cutting/shaving trends have been very visible due to the digital adoption during pandemic; DTH will continue to win at the cost of MSO’s. Shift to DTH will be favourable for broadcasters as it may enable better pay-outs for the latter

Our View

Most of the points above largely align with our view that TV segment looks promising if the Sony/Zee deal were to go through whereas the digital segment has concerns due to sheer dominance of Disney + and other video aggregators (MX and YouTube) as mentioned in our recent report (Zee Company Update – https://tinyurl.com/48s6fwx4- Report link); we continue to believe that TV ad revenue will see traction backed by festive ad spends and maintain our view that TV ad revenue will come back to 95% of pre COVID levels in FY22 (after reporting a decline of 15%-18% in FY21) as highlighted in our report (Media Sector Update -https://tinyurl.com/2j8pjcpy – Report link). Regional genre remains to be the key for driving above industry average growth for any broadcaster; NTO 2.0 will lead to a big shift towards ala carte consumption. We maintain our BUY rating on Zee with a Mar’22 TP of INR 390, however, the deal with Sony being called off is a risk for our target price as it factors a 25% multiple re-rating due to change in promoter group and enhanced governance practice.

SC tells petitioner to take plea on OTT platforms to govt.

SC tells petitioner to take plea on OTT platforms to govt.  Network18 TV news biz revenue up 28% in Q4 FY24

Network18 TV news biz revenue up 28% in Q4 FY24  As Zee gets lean, Punit Goenka in charge of critical verticals

As Zee gets lean, Punit Goenka in charge of critical verticals  Amazon miniTV expands reach with dubbed titles in Tamil, Telugu

Amazon miniTV expands reach with dubbed titles in Tamil, Telugu  Zing launches #NoBahanaDutyNibhana campaign

Zing launches #NoBahanaDutyNibhana campaign  COLORS to premiere ‘Laxmi Narayan’ on April 22

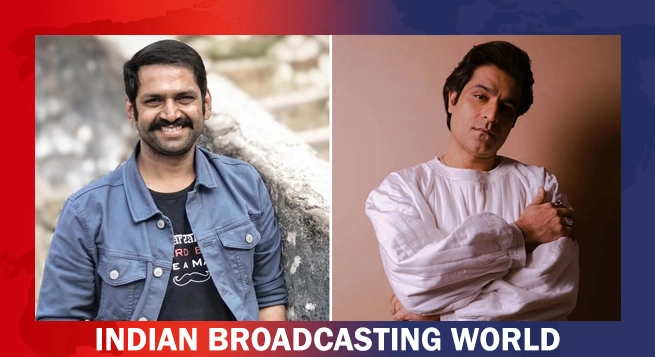

COLORS to premiere ‘Laxmi Narayan’ on April 22  Sharib Hashmi, Sunny Hinduja teams up with new play

Sharib Hashmi, Sunny Hinduja teams up with new play  Netflix CEO’s pay dips to $49.8mn in 2023

Netflix CEO’s pay dips to $49.8mn in 2023