The streaming wars are intensifying, and sports programming is emerging as a key battleground.

According to a recent report from Gracenote, the content data division of Nielsen, Amazon Prime Video, Disney+, and Netflix now collectively offer 92 percent of all sports-related content available on the world’s leading subscription video on-demand (SVOD) platforms.

This includes live games, sports news, highlight shows, and documentaries, underscoring these services’ dominant position in the sports entertainment space.

Gracenote’s latest Data Hub release reveals a quarter-over-quarter growth in available programming across major SVOD services, including Amazon Prime Video, Apple TV+, Disney+, Netflix, and Paramount+. Between February and May, the total number of unique TV shows, movies, and sports titles on these platforms grew by roughly 4,500 titles — an increase of about 5 percent. Netflix led this expansion, with an impressive 18.2 percent growth in total content during the second quarter, far surpassing its peers. Apple TV+ grew by 3.7 percent, Amazon Prime Video by 3.2 percent, Disney+ by 1.6 percent, and Paramount+ by 1 percent.

In terms of overall content share, Netflix now accounts for 20.1 percent of the available TV shows, movies, and sports programs on the top streaming services, up from 17.9 percent just a quarter earlier. Sports content itself grew by 7.8 percent across these platforms in the same period, outpacing movie growth (4 percent) and television programming growth (6.9 percent). This reflects the increasing demand and investment in sports as a vital category for streaming platforms aiming to attract and retain viewers.

Bill Michels, Chief Product Officer at Gracenote, highlighted the shifting landscape: “In the big picture for SVOD, overall content volume continues to rise but the CTV apps making this content available continually shift. Regardless of program type or any other attribute, effective content discovery helps streamers connect viewers to the entertainment they’ll enjoy most and get the most value out of each of the assets in their catalogs.”

Gracenote’s Data Hub, which tracks content trends in over 80 countries and 35 languages, offers interactive tools to analyze genre trends, exclusivity, and country of origin. This rich data resource aids video services, content owners, and advertisers in developing smarter strategies for content distribution, licensing, and media buying, while providing the media and analysts with critical insights into the fast-evolving streaming industry.

As the streaming ecosystem grows more crowded, sports content stands out as a key driver of growth and viewer engagement, with Amazon Prime Video, Disney+, and Netflix firmly established as the go-to destinations for sports fans worldwide.

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

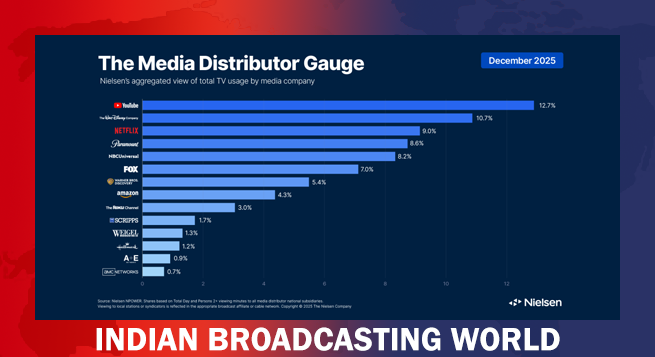

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate

Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate  Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’

Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’  Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem

Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem  Blackpink unveils first concept poster for comeback mini-album ‘Deadline’

Blackpink unveils first concept poster for comeback mini-album ‘Deadline’  SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release

SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release