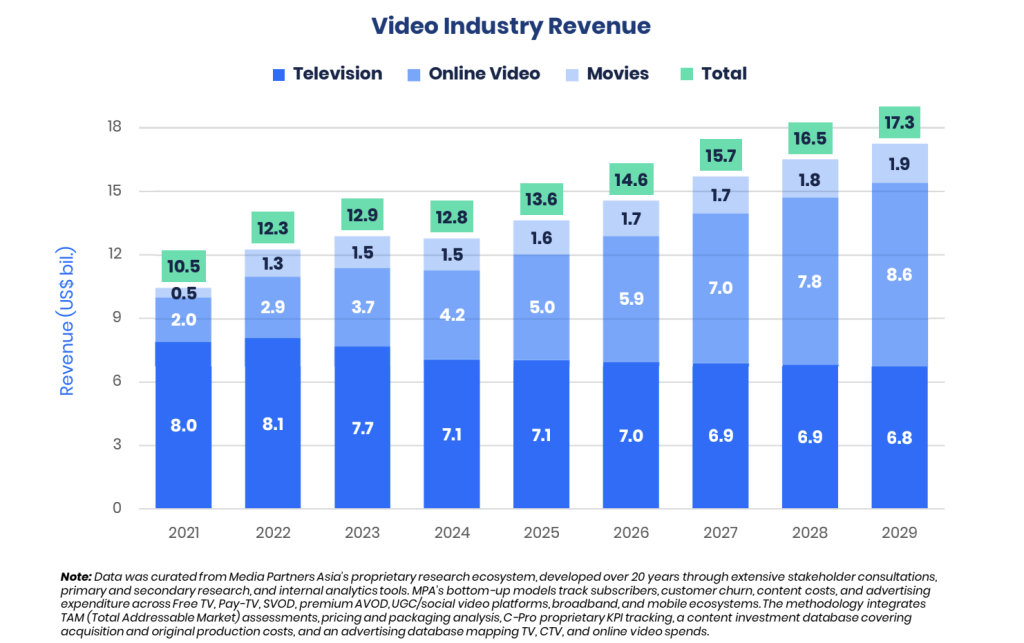

Sample some facts. India’s online video sector generated an estimated US$4.2 billion in 2024, with 75 percent driven by advertising and 25 percent from subscriptions. SVOD alone contributed US$1 billion. There are over 50 big and small OTT platforms in India (both global and domestic).

But no player is making money despite billions of dollars of investments over the years and despite streaming catching the fancy of Indians during COVID19 lockdown. Why? A big reason is piracy.

A new report, ‘The Impact of Piracy on India’s Online Video Sector and Creative Economy’ put together by IP House, Media Partners Asia and CII, and unveiled at WAVES last week, states that despite its scale and momentum, India’s online video sector faces significant revenue and growth constraints due to unchecked digital piracy.

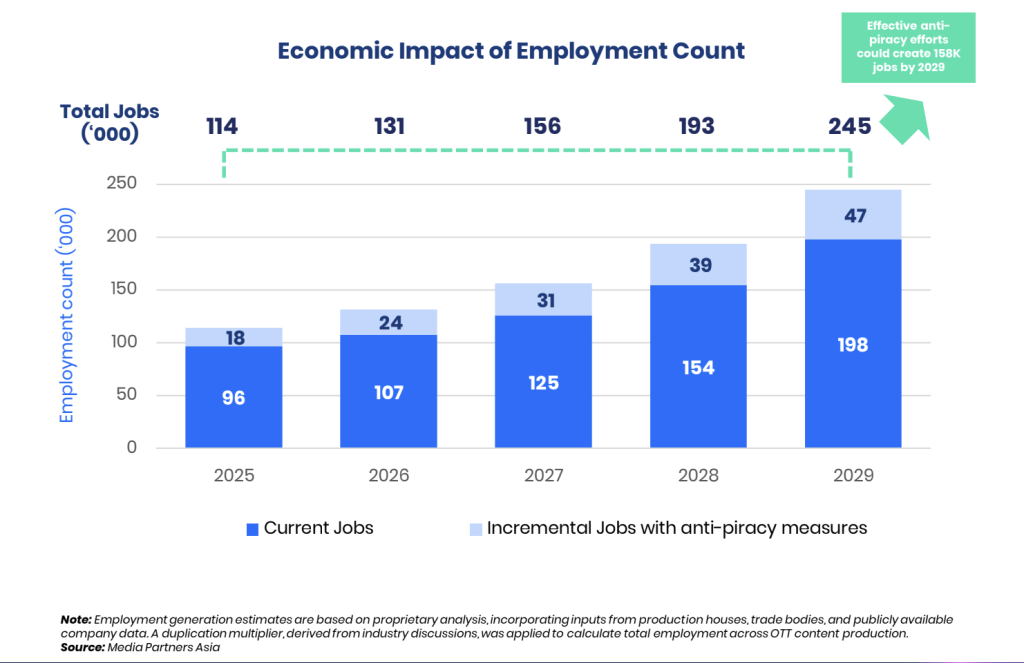

Without action, piracy could cost India’s digital video sector US$2.4 billion and 158 million users by 2029. With anti-piracy measures, the sector could recover US$1.1 billion in revenue, inject US$0.5 billion into content, and generate 47,000 jobs in 2029.

According to the report, in 2024, approximately 90 million users accessed pirated video content, resulting in US$1.2 billion in revenue loss—equivalent to 10 percent of the legal video industry.

“If unaddressed, piracy is projected to grow to 158 million users by 2029, increasing cumulative losses to US$2.4 billion and further constraining legitimate industry growth (in India),” the report states.

Effective anti-piracy measures offer a clear path forward. These interventions could also create over 158,000 new direct and indirect jobs between 2025-29, while reinforcing platform sustainability and tax contributions.

Anti-piracy interventions beginning in 2025 could help the premium online video sector recover over US$1.1 billion in lost earnings by 2029. Premium video revenue could reach US$5.7 billion by 2029 with effective anti-piracy measures

Effective anti-piracy measures could unlock a US$0.5 billion boost in content investment by 2029, raising the total value to US$3.8 billion — and reshaping India’s digital entertainment economy.

The next phase of India’s digital entertainment growth hinges on how effectively it tackles piracy. Combating piracy is no longer just about content protection, but about unlocking future growth, the report added.

Piracy doesn’t just drain revenues, it weakens the business case for content investment.

As OTT continues to outpace traditional formats like television and film, clamping down on piracy is essential to sustaining creative growth, securing jobs, and scaling India’s influence as a global content hub, the report advised.

Taking part in a panel discussion later at WAVES on piracy issues, MPA ED Vivek Couto said that online piracy is expected to cost the industry over 10 percent in lost revenue between 2025 and 2029, while “effective anti-piracy enforcement could drive a 25 percent increase in legal video service users and unlock a US$ 0.5 billion boost in content investment”.

Praveen Anand of Anand and Anand Associates emphasized that the solution lies in both technology and judicial reform.

“Tools like AI, blockchain, and watermarking are crucial. But we must also make camcording difficult with measures like metal detectors. Timely legal action is essential to create deterrence,” he noted.

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

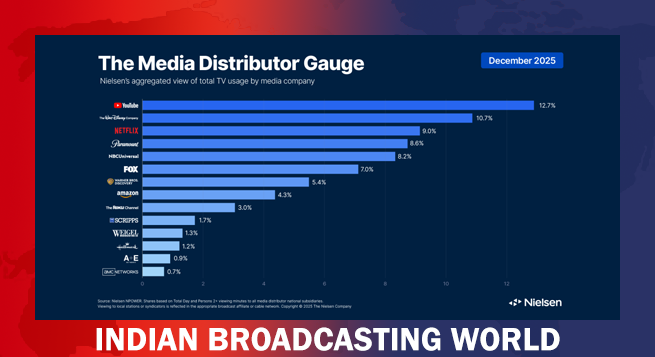

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate

Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate  Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’

Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’  Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem

Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem  Blackpink unveils first concept poster for comeback mini-album ‘Deadline’

Blackpink unveils first concept poster for comeback mini-album ‘Deadline’  SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release

SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release