A recent Supreme Court judgment allowing dual taxation on television broadcasting services could significantly increase the tax burden on digital entertainment platforms like Netflix, Amazon Prime Video, and gaming apps, according to tax experts and legal professionals, a report in The Economic Times stated yesterday.

The May 22 verdict, passed by a bench comprising Justices BV Nagarathna and NK Singh in the Asianet Satellite Communications and Others case, clarified that the act of broadcasting can be considered as two separate taxable activities — delivery of service and delivery of entertainment. As a result, both the Centre and state governments can impose separate taxes: service tax by the Centre and entertainment tax by the states.

The Economic Times report stated this dual-taxation model, although originating from a pre-GST era case, could have far-reaching implications for the current digital landscape.

“The ruling is mainly premised on the basis that both taxes deal with different aspects of broadcasting activities and hence, there is no overlap in taxing powers of the Centre and state,” said Saloni Roy, Partner, Deloitte India.

She added that the decision, despite relating to an earlier tax regime, introduces uncertainty in the industry and may influence current tax structures.

While GST was meant to streamline taxation, some states have already enacted their own laws allowing local bodies to impose entertainment duties.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

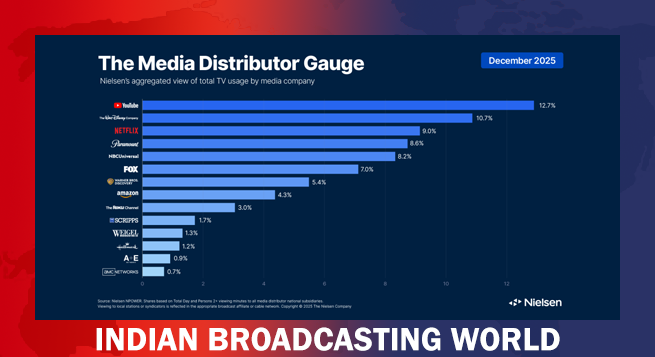

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  Fourth Dimension Media Solutions marks 15 years of industry leadership

Fourth Dimension Media Solutions marks 15 years of industry leadership  Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’

Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’  Ananya Birla forays into cinema with launch of Birla Studios

Ananya Birla forays into cinema with launch of Birla Studios  Travelxp launches HD/4K on Makedonski Telekom in Balkans

Travelxp launches HD/4K on Makedonski Telekom in Balkans  India Today Group named exclusive media partner for WGS Dubai

India Today Group named exclusive media partner for WGS Dubai