The News Broadcasters & Digital Association (NBDA), an apex body representing 24×7 television and digital news broadcasters across India, has submitted a formal representation to the Finance Minister and Chairperson of the GST Council Nirmala Sitharaman, highlighting the challenges that the current Goods and Services Tax (GST) framework poses for the financial and operational stability of the news broadcasting and digital industry.

In the communication, dated August 28, NBDA has exhorted the government to tweak the taxation framework so that the point of

taxation for GST in the case of the TV and digital news broadcasting industry for the sale of advertising space — particularly to government agencies like DAVP, public sector firms and State Governments — should be “shifted from invoicing (under Section 13 of the Central Goods and Services Tax Act, 2017) to the collection/receipt of payments”.

NBDA rationale: payment cycles are often known to be for an extended period of 120 to 180 days, while on some occasions payments are even contested by clients and don’t materialise.

According to an official media statement yesterday from the NBDA, which represents 29 leading broadcasters and digital platforms commanding over 80 percent of television news eyeballs, the organisation highlighted the challenges the industry is already facing from rapid technological changes, rising operational costs and audience fragmentation.

The industry is compelled to deposit GST even before receiving payments, creating significant cash flow mismatches, the NBDA observed, adding that this leads to borrowing at high interest rates, thus increasing financial burden and, in some cases, permanent losses when payments are delayed indefinitely or not received at all.

In this context, GST compliance requirements have become disproportionately burdensome, leading to liquidity stress and increased compliance risks, it observed.

Another serious compliance complication arises due to mismatches between the timing of GST liability and the deduction of tax deducted at source (TDS) by the government departments under Section 51 of the CGST Act.

Since TDS is deducted only at the time of payment, while GST liability is triggered at invoicing, broadcasters are frequently subjected to scrutiny notices and litigation, adding to the cost of compliance and uncertainty in operations.

According to the NBDA, the changes sought by it would bring four major benefits: (i) improved cash flows aligned with revenue inflows (ii) reduced dependence on costly borrowed funds (iii) enhanced operational efficiency by freeing resources for content and technology investment and (iv) reduced litigation arising from compliance mismatches, thereby promoting ease of doing business in the media sector.

The news industry lobbying body has also highlighted the restrictions on input tax credit (ITC) under Section 17(5) of the CGST Act.

Presently, ITC is disallowed on certain expenses even if they are incurred in the course of business operations. For the news broadcasting industry, these include vehicle hire for reporters, food and beverages and catering during events, beauty treatments essential for on-air professionals and insurance coverage for employees who often work in high-risk environments.

NBDA argued that these expenses were integral to the functioning of news channels and digital platforms, and the denial of ITC leads to higher operational costs, ultimately undermining the financial viability of the sector.

In conclusion, NBDA has urged the government to consider its proposals for shifting the point of taxation to the receipt of payments for government advertising business and allowing ITC on essential business expenditures. Such rationalisation, it emphasized, would create a more equitable tax environment, reduce compliance friction and strengthen the sustainability of India’s news broadcasting ecosystem.

Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  SPNI picks up media rights of DP World Tour Golf tourney

SPNI picks up media rights of DP World Tour Golf tourney  BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini

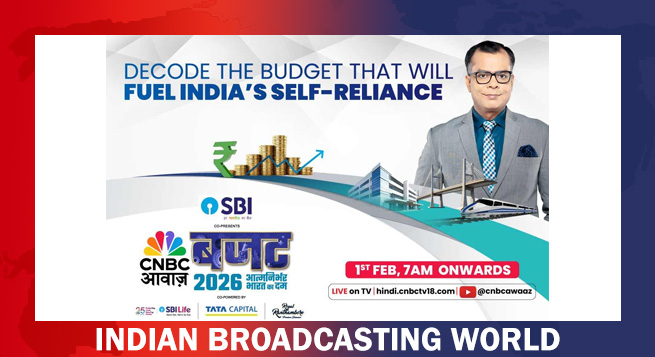

BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini  CNBC-AWAAZ unveils ‘Aatma Nirbhar Bharat ka Dum’ for Union Budget 2026

CNBC-AWAAZ unveils ‘Aatma Nirbhar Bharat ka Dum’ for Union Budget 2026  ‘Housefull 2’ trio reunites on Akshay Kumar hosted ‘Wheel of Fortune’

‘Housefull 2’ trio reunites on Akshay Kumar hosted ‘Wheel of Fortune’  Panorama Studios partners Phars Film for overseas release of 4 Malayalam films

Panorama Studios partners Phars Film for overseas release of 4 Malayalam films  Arijit Singh announces retirement from playback singing

Arijit Singh announces retirement from playback singing  Amy Madigan boards Netflix limited series ‘All The Sinners Bleed’

Amy Madigan boards Netflix limited series ‘All The Sinners Bleed’