The US and Europe are ‘Neflix’d out’ and Netflix needs to turn to ‘emerging’ markets such as India if it wants to stop its falling new subscriber numbers and plummeting share price, according to leading data and analytics company GlobalData.

Netflix is expected to spend an eye-watering $18 billion on content this year, but this will fail to attract new subscribers unless the company recognizes that many of its markets are reaching ‘peak Netflix’, GlobalData said in a statement put out on its website.

It said its analysis highlights that India holds a lot of promise for Netflix, with subscription-video-on-demand (SVoD) penetration in the country expected to increase from 24 percent in 2021 to 42 percent in 2026, and streaming subscriptions forecast to reach 191 million by 2026.

Francesca Gregory, Associate Analyst at GlobalData, commented: “Netflix’s results may have come at a surprise to some, as the platform’s content has been strong. However, being a big spender won’t necessarily grow subscriber numbers in the company’s traditional markets. The US and European markets are completely saturated, with customers having a growing number of competitors to choose from. Therefore, streaming companies’ mantra of ‘content is king’ is no longer guaranteeing ideal subscriptions growth. Netflix will need to refine its emerging economy strategy, which has been seriously lacking.”

Elaborating on her analysis, Gregory said that India “holds one of the greatest opportunities for growth”. While Netflix has been slow to act in India, its competitors have moved early and secured their positions — with a third of Disney+ subscribers emanating from the country, for example, she added.

The reasons that Netflix has struggled to unlock the potential of the Indian SVoD market are twofold: lack of regionalized content and high prices.

Gregory added: “If the company wants to spend big, surely it can spare a portion to grow its local Indian content. As for price, the company may have already slashed prices to accommodate to lower disposable incomes in India, but its initial lack of affordability cost the company its market position. Netflix currently trails well behind competitors in the country, holding just 4 percent market share while Disney+ holds 68 percent.

“Netflix will need to work hard to address these problems going forward. One way is regionalized content initiatives. In the past, the company has been criticized for confusing its cultural references in its original shows. Further blunders like this will stifle any hope of Netflix reversing its weak position in India.”

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

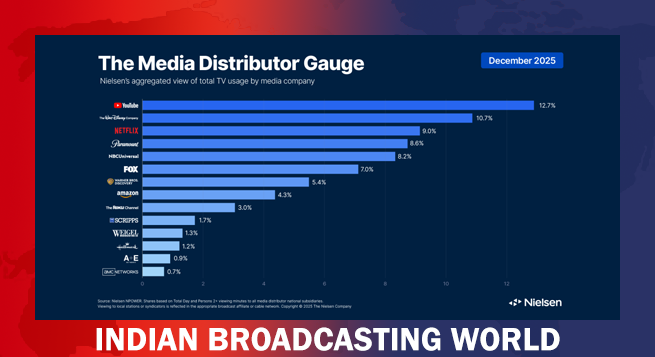

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate

Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate  Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’

Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’  Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem

Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem  Blackpink unveils first concept poster for comeback mini-album ‘Deadline’

Blackpink unveils first concept poster for comeback mini-album ‘Deadline’  SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release

SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release