Comcast lost more broadband customers than expected in the fourth quarter, as intensifying competition in the US internet market continued to weigh on the company’s core business, even as strength in its theme parks and streaming segments helped cushion the overall performance.

According to a Reuters report, the media and telecom major said it lost 181,000 broadband customers during the quarter, slightly higher than market expectations of a decline of around 173,780 users, as estimated by FactSet. Aggressive promotional offers from high-speed fibre providers and the rapid expansion of cheaper fixed-wireless internet services have significantly ramped up competition in a market long dominated by players such as Comcast and Charter Communications.

The company acknowledged the pressure on its broadband business and said it would not raise prices this year in an effort to remain competitive. Instead, Comcast is revamping its service packages, increasing bundling options and offering free mobile lines to retain and attract customers. However, analysts remain cautious and do not expect meaningful customer growth to return before 2027. Comcast said it plans to convert a sizeable share of users currently on free mobile lines into paid customers in the second half of 2026.

On the financial front, Comcast reported total revenue of $32.31 billion for the three months ended December, largely in line with analyst expectations of $32.35 billion, as per LSEG data. The overall performance was supported by a standout quarter for its theme parks business, led by Epic Universe in Orlando. Revenue from the segment surged 21.9 percent to $2.98 billion, marking its strongest quarter on record.

The company’s Peacock streaming service also showed signs of renewed momentum, adding three million paid subscribers after a subdued 2025. The growth was driven by the addition of National Basketball Association games and an exclusive National Football League deal. However, the cost of securing these rights widened Peacock’s losses to $552 million during the quarter.

Commenting on the outlook, co-CEO Mike Cavanagh said NBCUniversal is expected to deliver roughly 40 percent of the industry’s major live events in 2026, including marquee properties such as the Super Bowl and the Winter Olympics, reinforcing the group’s position in live sports and event programming.

Comcast’s free cash flow for the quarter came in at $4.37 billion, comfortably ahead of analysts’ estimates of $2.23 billion. Adjusted profit stood at 84 cents per share, beating expectations of 75 cents. Shares of the company rose around 3 percent in early morning trading following the results, reflecting investor confidence in the company’s diversified revenue streams despite ongoing challenges in broadband.

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

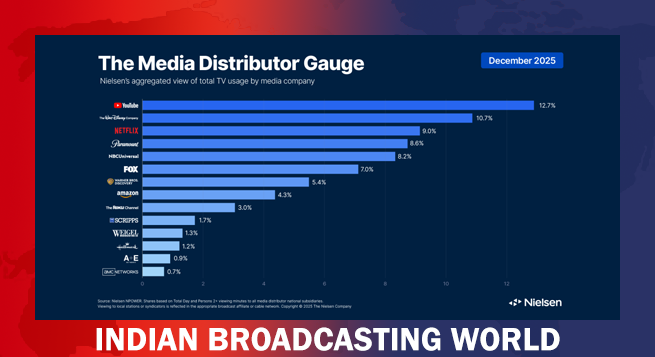

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate

Nine minutes missing from Netflix version of ‘Dhurandhar’ sparks debate  Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’

Vishal Mishra’s ‘Kya Bataun Tujhe’ sets emotional tone for ‘Pagalpan’  Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem

Anirudh Ravichander lends voice and music to ICC Men’s T20 World Cup 2026 anthem  Blackpink unveils first concept poster for comeback mini-album ‘Deadline’

Blackpink unveils first concept poster for comeback mini-album ‘Deadline’  SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release

SS Rajamouli–Mahesh Babu’s ‘Varanasi’ set for April 7, 2027 theatrical release