India’s telecommunications sector has reached a significant milestone with 365 million 5G subscribers as of July, marking nearly 35 per cent penetration in just three years since the rollout of the high-speed technology. The growth underscores the rapid transformation in consumer usage patterns and data consumption across the country.

According to The Economic Times report, average monthly data usage per user has surged to between 18GB and 55GB, up sharply from 6GB to 11GB in FY19. The agency said the rise reflects evolving user behaviour and increasing adoption of digital services, with all three major private telecom operators registering quarterly increases in data consumption since the introduction of 5G.

Broadband services have also shown exceptional momentum. Monthly additions crossed 4.2 million subscribers in June and July 2025, outpacing the overall industry subscriber growth of 1–2.5 million during the same period. This surge lifted broadband penetration levels to 80.1 per cent by July, compared to 77.3 per cent a year earlier.

Despite tariff hikes introduced by operators in mid-2024, the overall telecom subscriber base—wireless and wired combined—expanded to 1.22 billion in July, up from 1.2 billion a year ago. While the wireless base held steady at 1.172 billion year-on-year, steady monthly growth has been observed since December 2024.

Among the top three players, Reliance Jio and Bharti Airtel have continued to post subscriber gains, offsetting losses faced by Vodafone Idea over the past six to seven months. Active subscribers, measured through visitor location registers, rose by 2 per cent annually to more than 1.08 billion, taking the active user ratio to 93.1 per cent, compared to 90.6 per cent a year ago.

Ind-Ra noted that this improvement was largely driven by growth in active users for Reliance Jio, which saw a 5.8 per cent year-on-year rise, and Bharti Airtel, which posted 1.3 per cent growth. These gains more than compensated for the continuing decline in Vodafone Idea’s active subscriber base.

The report highlights that India’s telecom market, despite challenges of rising tariffs and financial stress on operators, remains one of the fastest-growing globally, driven by strong demand for digital services, high-speed data, and expanding broadband access.

Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  SPNI picks up media rights of DP World Tour Golf tourney

SPNI picks up media rights of DP World Tour Golf tourney  BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini

BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini  NDTV Profit rolls out ‘Return on Watching’ campaign ahead of Union Budget 2026

NDTV Profit rolls out ‘Return on Watching’ campaign ahead of Union Budget 2026  ‘Dhurandhar’ set for Netflix debut on January 30

‘Dhurandhar’ set for Netflix debut on January 30  Amazon MX Player announces revenge drama ‘Ab Hoga Hisaab’

Amazon MX Player announces revenge drama ‘Ab Hoga Hisaab’  MTV Splitsvilla X6 returns with star-studded sponsor lineup

MTV Splitsvilla X6 returns with star-studded sponsor lineup  Vijay Deverakonda, Rashmika Mandanna gear up for period drama ‘Ranabaali’

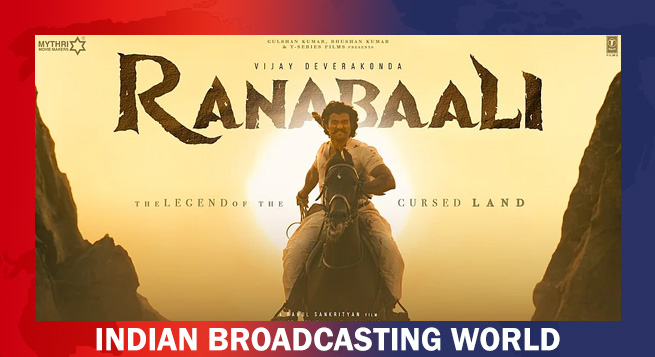

Vijay Deverakonda, Rashmika Mandanna gear up for period drama ‘Ranabaali’