US-based broadcaster Discovery Inc. is holding informal discussions about a potential takeover bid for Britain’s state-owned Channel 4 television broadcaster, The Telegraph reported on Saturday.

The potential bid process is being managed by UK Government Investments, the paper reported, adding that a deal was not expected to be completed until the middle of next year, according to Reuters that quoted The Telegraph.

Discovery did not immediately respond to a request for comment.

Britain’s government on July 6 announced a consultation on the sale of Channel 4, and it was considering changes to the operating model of the broadcaster, including its ownership, remit and obligations.

The advertising-funded Channel 4, whose hit shows include “The Great British Bake Off”, was set up with a remit to provide challenging and distinctive programming for audiences under-served by traditional broadcasters.

Comcast’s Sky also exploring a bid for Channel 4, Telegraph reported.

In its 2020 annual report, Channel 4 said its revenues were 934 million pounds, down 5 percent from 2019, with a pre-tax surplus of 74 million pounds, the highest in its 38-year history. Viewing share for its TV channel portfolio rose two percent to 10.1 percent, its first year-on-year increase since 2011. It set a target of doubling viewing by 2025.

GTC Network names Sardana western India sales head

GTC Network names Sardana western India sales head  Govt’s OTT accessibility guidelines gives 36-month implementation period

Govt’s OTT accessibility guidelines gives 36-month implementation period  Prasar Bharati adopting digital-first content strategy: Murugan

Prasar Bharati adopting digital-first content strategy: Murugan  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Oscar-nominated ‘The Secret Agent’ set for India release on Feb 27

Oscar-nominated ‘The Secret Agent’ set for India release on Feb 27  Sunny Deol, Preity Zinta-starrer ‘Lahore 1947’ to hit theatres on Aug 13

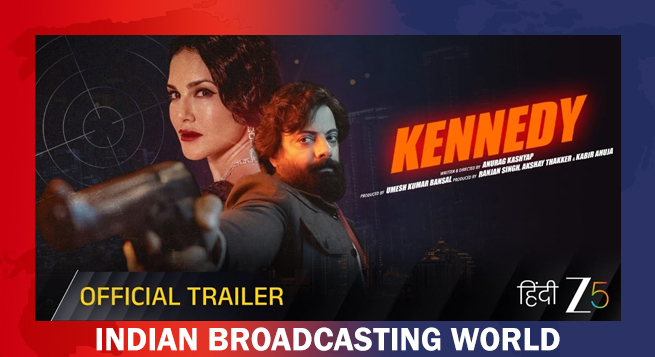

Sunny Deol, Preity Zinta-starrer ‘Lahore 1947’ to hit theatres on Aug 13  ZEE5 drops trailer of ‘Kennedy’, premieres Feb 20

ZEE5 drops trailer of ‘Kennedy’, premieres Feb 20  JioStar appoints Anvita Thapliyal as VP, content regulation

JioStar appoints Anvita Thapliyal as VP, content regulation  Offbeet Media Group appoints Abhijeet Rathor as CBO

Offbeet Media Group appoints Abhijeet Rathor as CBO