Paramount Skydance is preparing a bid to buy Warner Bros Discovery, a source familiar with the matter told Reuters on Thursday, potentially bringing together two storied Hollywood studios and reshaping the entertainment industry.

A bid for Warner Bros Discovery would be backed by the Ellison family, which includes Skydance head David Ellison and his father, billionaire Oracle co-founder Larry Ellison, according to the Wall Street Journal, which first reported the news, citing unnamed sources.

The audacious bid, coming just weeks after Skydance bought Paramount Global for $8.4 billion, would unite some of the best-known entertainment brands under a single corporate shingle, bringing together DC Comics superheroes like Superman and Nickelodeon’s SpongeBob SquarePants, science-fiction franchises like ‘The Matrix’ and ‘Star Trek’ and two major news networks, CBS News and CNN.

“This deal is the Hollywood equivalent of a sequel no one expected but everyone sort of saw coming,” said eMarketer analyst Jeremy Goldman. No offer has been submitted and the plans could still fall apart, the WSJ reported.

Still, shares of Warner Bros Discovery surged as much as 30 percent after the news while Paramount’s jumped 15 percent. Paramount and Warner Bros declined to comment on the report.

Warner Bros Discovery has been reorganizing its media business to split its declining cable television business from its studio and streaming units. Skydance, however, is seeking to acquire all of Warner Bros Discovery’s media assets, including its Warner Bros film studio, HBO, and CNN, in a mostly cash deal, the WSJ reported. “For WBD shareholders, a cash-rich exit is far more appealing than waiting around for Zaslav’s restructuring magic to (maybe) pay off,” eMarketer’s Goldman said. That referred to CEO David Zaslav’s plan to separate Warner Bros Discovery’s cable business from its studios and streaming operations, unwinding a merger that took place less than four years ago. If successful, the deal would bring together two of Hollywood’s best-known studios as well as streaming services HBO MAX and Paramount+. It would need the deep pockets and political clout of Larry Ellison, a long-time ally of U.S. President Donald Trump to come together and clear monopoly concerns.

The potential bid underscores intensifying competition in the media sector, as traditional players race to gain scale and strengthen their streaming services as TV viewership and advertising revenue decline.

They face heightened competition from deep-pocketed technology giants Apple and Amazon.com, whose streaming services compete for talent and valuable sports rights.

Such a deal is likely to face antitrust scrutiny, legal experts said. “The DOJ will want to investigate whether the merger could lead to higher prices for consumers, reduce bargaining power for creators and diminish content diversity,” said Andre Barlow, an antitrust attorney in Washington. “At the same time, the Trump administration’s DOJ Antitrust Division could be more lenient toward the deal compared to the prior Biden era’s aggressive stance.” The combination would reduce the number of independent major studios, giving the merged entity greater market share in theatrical releases, home entertainment and content licensing, Barlow said. Merging the two companies’ cable businesses could increase its bargaining power, which could lead to higher ad rates and carriage fees with cable providers, he added.

The combination would create a stronger streaming rival to Netflix, Disney and Comcast.

Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  SPNI picks up media rights of DP World Tour Golf tourney

SPNI picks up media rights of DP World Tour Golf tourney  BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini

BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini  NDTV Profit rolls out ‘Return on Watching’ campaign ahead of Union Budget 2026

NDTV Profit rolls out ‘Return on Watching’ campaign ahead of Union Budget 2026  ‘Dhurandhar’ set for Netflix debut on January 30

‘Dhurandhar’ set for Netflix debut on January 30  Amazon MX Player announces revenge drama ‘Ab Hoga Hisaab’

Amazon MX Player announces revenge drama ‘Ab Hoga Hisaab’  MTV Splitsvilla X6 returns with star-studded sponsor lineup

MTV Splitsvilla X6 returns with star-studded sponsor lineup  Vijay Deverakonda, Rashmika Mandanna gear up for period drama ‘Ranabaali’

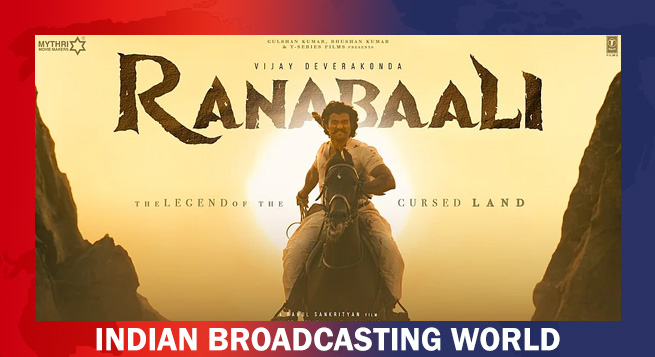

Vijay Deverakonda, Rashmika Mandanna gear up for period drama ‘Ranabaali’