India’s Reliance Jio Infocomm Ltd. is in talks to raise a loan for about $1.6 billion to fund the purchase of equipment from Nokia Oyj, according to people familiar with the matter.

Banks involved in the discussions with billionaire Mukesh Ambani’s telecoms company include Citigroup Inc., HSBC Holdings Plc. and JPMorgan Chase and Co., said the people, who asked not to be named because the matter is private, according to a Bloomberg report.

The loan will likely have a maturity of as much as 15 years and will be priced over the Secured Overnight Financing Rate, they said.

As the deal has not yet been finalized, the lineup of banks and the terms may still change. Finland’s export credit agency, Finnvera, will issue guarantees covering the majority of the loan, they said.

Nokia announced last October that it had clinched an agreement to supply Jio with equipment for its 5G rollout in India. Ambani’s Reliance Industries Ltd. was first out of the starting blocks to offer 5G in India, after investing billions of dollars to acquire the airwaves.

JPMorgan, Citibank and HSBC declined to comment. A Nokia spokesperson declined to comment when contacted by Bloomberg about the loan talks, as did Finnvera. A representative of Reliance Industries declined to comment.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

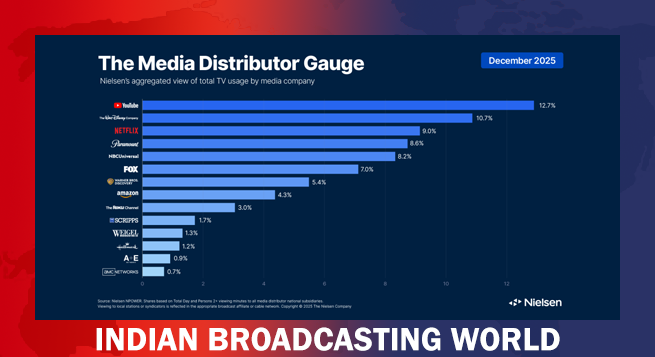

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  Fourth Dimension Media Solutions marks 15 years of industry leadership

Fourth Dimension Media Solutions marks 15 years of industry leadership  Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’

Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’  Ananya Birla forays into cinema with launch of Birla Studios

Ananya Birla forays into cinema with launch of Birla Studios  Travelxp launches HD/4K on Makedonski Telekom in Balkans

Travelxp launches HD/4K on Makedonski Telekom in Balkans  India Today Group named exclusive media partner for WGS Dubai

India Today Group named exclusive media partner for WGS Dubai