The Union government has notified amendments to GST law regarding the valuation methodology to be used by online gaming companies and casinos to calculate tax.

The finance ministry notified on September 6 the amendments to the Central GST law for calculating the value of supply in the case of online gaming and casinos, as per the GST council’s decision last month in its meeting on August 2.

The notification clarified that any player’s winnings would remain tax-neutral, as the entire tax is collected only at the first stage, IANS reported.

The amendments were made as part of the Central Goods and Services Tax (CGST) rules 2017, which were updated in the CGST (Third Amendment) rules 2023.

This means that the total amount deposited with a platform or online gaming service will be considered taxable sales value, and any amount returned or refunded by the casino or gaming portal will not be deducted from the value of the supply of online money gaming.

Simply put, once a given amount is deposited with the platform, tax will be imposed on the whole amount, irrespective of the part of the deposit returned to the player at a later point.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

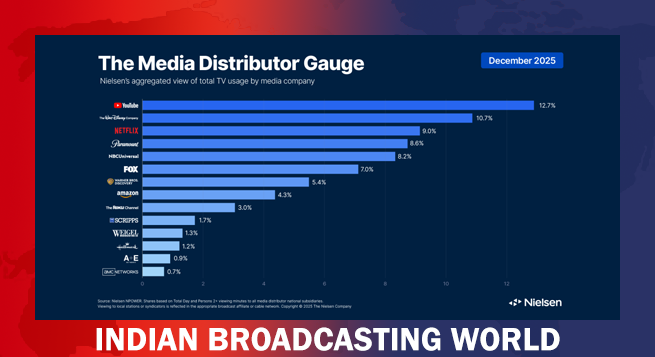

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  Fourth Dimension Media Solutions marks 15 years of industry leadership

Fourth Dimension Media Solutions marks 15 years of industry leadership  Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’

Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’  Ananya Birla forays into cinema with launch of Birla Studios

Ananya Birla forays into cinema with launch of Birla Studios  Travelxp launches HD/4K on Makedonski Telekom in Balkans

Travelxp launches HD/4K on Makedonski Telekom in Balkans  India Today Group named exclusive media partner for WGS Dubai

India Today Group named exclusive media partner for WGS Dubai