Bharti Airtel on Tuesday said it does not agree with an order it received under the Central Goods and Services Tax Act for a levy of Rs 24.94 lakh penalty and will take suitable action for rectification or reversal.

The violation pertains to alleged irregular input tax credit claims from 2017-18 to 2021-22 and other related matters, Airtel said in a BSE filing.

Submitting details of the orders received by the company under the Central Goods and Services Tax Act, Airtel said the order was received on December 24, PTI reported.

The order entails a levy of a penalty of Rs 24,94,316, it said, adding, “The company does not agree with the order and will take appropriate action for rectification or reversal of the same.”

“The maximum financial impact is to the extent of the penalty levied,” it said.

Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

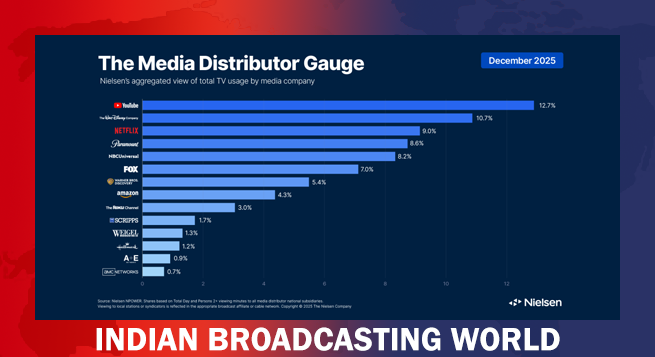

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  ‘Devdas’, ‘Tere Naam’,‘Yuva’ set for big-screen return this Feb

‘Devdas’, ‘Tere Naam’,‘Yuva’ set for big-screen return this Feb  First trailer of ‘The Devil Wears Prada 2’ unveiled, set for May 2026 release

First trailer of ‘The Devil Wears Prada 2’ unveiled, set for May 2026 release  Prime Video drops February slate: new originals, series, sports

Prime Video drops February slate: new originals, series, sports  Offbeet Media appoints Rohit Tugnait as CEO of 101 India

Offbeet Media appoints Rohit Tugnait as CEO of 101 India  Colors Gujarati launches two new shows

Colors Gujarati launches two new shows