It’s 15 years since Sweden’s Spotify Technology, co-founded by Daniel Ek, launched its music streaming service as a legal all-you-can-eat middle ground between online piracy and paying $20 for an album.

At the time, the music industry was slashing jobs and struggling with the MP3’s rise: In the digital domain, “copies are not just cheap, they are free,” technologist Kevin Kelly wrote in 2008.

Today, Ek is a billionaire, and streaming has helped the music biz get back to its pre-MP3 size. Yet Spotify is now cutting 1,500 jobs as the industry’s foundations get rocked again. Even with more than half a billion unique users, technology that seems to understand our listening tastes better than we do ourselves (the annual Spotify Wrapped is said to be cognitively “irresistible”), and more content than we could listen to in a lifetime, Ek faces an existential challenge: Is Spotify a financially sustainable business? Bloomberg reported.

This question has long dangled over Spotify — and every streaming platform — as those $9.99 subscription fees (now $10.99) are reinvested in the service of Silicon Valley-style user growth by buying more content. The slick tech engine at the core of its business needs R&D, but it also still depends on the Taylor Swifts and Drakes of this world for its fuel — as Swift herself proved when she temporarily yanked her music from Spotify in 2014, criticizing the fractions-of-a-cent royalties paid to artists. As tiny as those payouts are — Vulfpeck’s Jack Stratton calls them “pities” — the negotiating power of labels has capped Spotify’s profitability.

Swift’s songs have made her a billionaire, but streaming remains a very unequal model for artists and a costly one for Ek, who has splurged even more to expand into lucrative non-musical content such as podcasts. Results have been decidedly mixed, as shown by the eye-watering $1 billion spent on swish studios and celebrity hosts including the Obamas. Yes, there’s been growth, with Spotify’s revenue twice what it was in 2018, but at the cost of perennial losses and new headaches like content moderation — such as when Joe Rogan’s podcast sparked outrage over COVID misinformation. In a world of higher interest rates, investors are impatient for change; Spotify has underperformed the S&P 500 by more than 50 percentage points on a total return basis since going public.

Hence why Ek is frantically pulling all possible levers to change course. Cost savings worth $300 million are expected to bring the company into the black next year, according to Macquarie Group analysts, and Ek’s memo announcing 1,500 job cuts — even his CFO has gone — shows how the tone from the top is becoming more businesslike. Subscription fees are finally going up after years of having been stuck below-$10 a month. And even if the podcast bubble has burst, listeners do seem to want more of the spoken word, with audiobooks set to retain paying users on the platform. That means higher margins for Spotify than in music, according to Bloomberg Intelligence, as well as more ad revenue.

But none of that is wholly reassuring with so many unpredictable market forces coalescing on the horizon. Competing with music services offered by Apple and Amazon.com might get harder in a more cost-conscious marketplace (antitrust moves against Big Tech notwithstanding). Consumers may get fed up at paying more for content that’s at odds with what made Spotify irresistible in the first place — imagine if algorithms start trying to nudge listeners into a cozy crime audiobook after an hour of Frank Zappa. And tomorrow’s generation of creators might be put off for good if artificial intelligence leads to a deluge of machine-made, royalty-free content, meaning more reliance on yesterday’s hits that are less valuable than people think. Spotify’s target of $100 billion in revenue by 2030 looks wildly optimistic, implying an eightfold rise for a service already in 178 countries.

Spotify isn’t going to suddenly disappear the way compact discs did. But pressure on Ek to improve his business model is only going to build — with a likely reality check for its valuation. Its premium-tech multiple of six times next year’s revenue is higher than Netflix’s, yet the latter has more exclusive content and less of a climb ahead, with gross margins expected to reach 47% in 2025, almost double Spotify’s. A pivot to profit may mean Spotify reveals itself to be more akin to a media company than the next Meta Platforms: Barclays analysts reckon the platform should ditch its one-price-fits-all mentality and try to squeeze more money out of super-fans and those listening to the most popular artists.

Telecom subs base up marginally to 119.9 cr. in March: Trai

Telecom subs base up marginally to 119.9 cr. in March: Trai  CCI okays Airtel’s acquisition of Warburg Pincus DTH stake

CCI okays Airtel’s acquisition of Warburg Pincus DTH stake  NDTV Marathi, 6th news channel from the stable, launched

NDTV Marathi, 6th news channel from the stable, launched  WhatsApp bans over 79 lakh accounts in India in March

WhatsApp bans over 79 lakh accounts in India in March  Prime Video drops official trailer for ‘The Boys’ S4

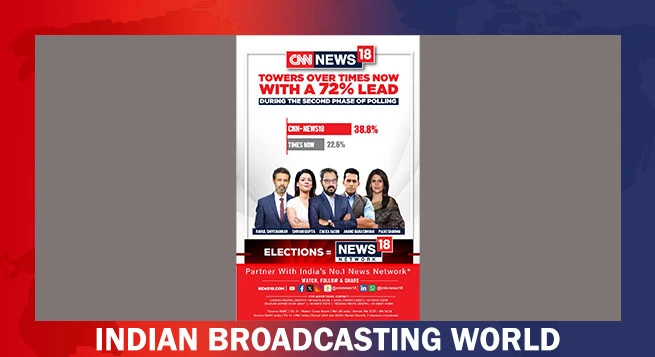

Prime Video drops official trailer for ‘The Boys’ S4  CNN-News18 maintains dominance with 72% lead over Times Now in second phase of elections

CNN-News18 maintains dominance with 72% lead over Times Now in second phase of elections  Nushrratt Bharuccha’s ‘Akelli’ now streaming on JioCinema

Nushrratt Bharuccha’s ‘Akelli’ now streaming on JioCinema  Games24x7 elevates Tridib Mukherjee to Chief Data Science, AI Officer

Games24x7 elevates Tridib Mukherjee to Chief Data Science, AI Officer