Network18’s ‘Reforms Reloaded’ on Tuesday brought together some of the country’s most influential policymakers, economists, business leaders, and strategists to deliberate on the next phase of India’s economic journey.

The focus was on the rollout of GST 2.0 reforms, which officially came into effect on September 22, 2025, and their potential to reshape India’s tax ecosystem and accelerate growth.

According to a Network18 press release, the high-powered forum examined how GST 2.0 could transform industries, empower enterprises, and stimulate consumption-led expansion, while also addressing India’s broader reform agenda spanning asset monetisation, divestment, defence indigenisation, and renewable energy.

The discussions highlighted the opportunities and challenges in aligning India’s bold policy ambitions with ground realities, as the country aims to solidify its standing on the global stage.

Opening the dialogue, CEOs and industry leaders shared market sentiments from the first day of the new GST framework. Arunish Chawla, Secretary, Department of Investment and Public Asset Management (DIPAM), underlined how the government has managed a balanced approach to support the economy with GST reforms, tax relief, and consistent public investment. He revealed that 33percent of the year’s public investment target had already been achieved by July, adding that despite foreign institutional investors pulling out Rs.1 lakh crore between January and August, domestic institutional investors had invested Rs.5 lakh crore, a testament to the “democratisation of capital markets.”

On the GST front, Chief Economic Advisor V. Anantha Nageswaran called GST 2.0 “a landmark reform” that will significantly boost domestic demand and GDP growth. “India’s FY26 GDP growth will tend towards the upper end of the 6.3–6.8 per cent range following GST 2.0 reforms,” he said, emphasising the multiplier impact of indirect tax concessions combined with measures announced in the Union Budget.

Union Tourism Minister Gajendra Singh Shekhawat pointed out the reforms’ widespread impact, noting that 95percent of goods will see reduced tax rates. “This will benefit everyone, from a farmer to a millionaire in Mumbai, by putting more disposable income in people’s hands and fuelling consumption. Tourism will be one of the big beneficiaries,” he added.

Meanwhile, Defence Secretary Rajesh Kumar Singh highlighted the government’s resolve towards indigenisation in the defence sector, stating that India will spend $25–30 billion annually on defence capital expenditure over the next decade, with at least 75percent of it being invested within the country.

Describing GST 2.0 as “the biggest reform since 1975,” Consumer Affairs Minister Pralhad Joshi said the government has established mechanisms, including a dedicated helpline, to ensure GST benefits are passed on to consumers. He underlined that compliance has been simplified and refunds are now fully digitised, offering major relief to businesses.

Through power-packed sessions and candid conversations, Reforms Reloaded 2025 underscored optimism about India’s reform trajectory. The discussions reinforced GST 2.0 as a catalyst for building a competitive, consumption-driven economy—one that not only strengthens GDP numbers but also enhances India’s credibility on the global economic map.

Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  SPNI picks up media rights of DP World Tour Golf tourney

SPNI picks up media rights of DP World Tour Golf tourney  BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini

BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini  BECIL hunts for partners to manage govt clients’ SM projects

BECIL hunts for partners to manage govt clients’ SM projects  Rabindra Narayan’s new project GTC News starts GSAT30 test signals

Rabindra Narayan’s new project GTC News starts GSAT30 test signals  TV9 Network hosts Auto9 Awards ’25 to spotlight mobility landscape

TV9 Network hosts Auto9 Awards ’25 to spotlight mobility landscape  NDTV Good Times brings Honey Singh’s My Story back to India

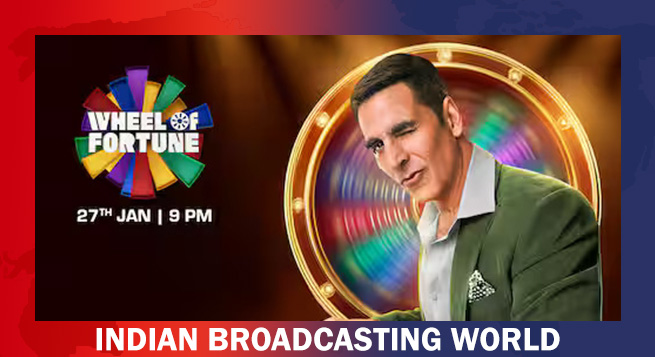

NDTV Good Times brings Honey Singh’s My Story back to India  Sony onboards major brands as sponsors for ‘Wheel of Fortune’

Sony onboards major brands as sponsors for ‘Wheel of Fortune’  Amazon unveils popular franchise ‘Masters of the Universe’ trailer

Amazon unveils popular franchise ‘Masters of the Universe’ trailer  Record 96bn hours of content watched on Netflix July-Dec 2025

Record 96bn hours of content watched on Netflix July-Dec 2025