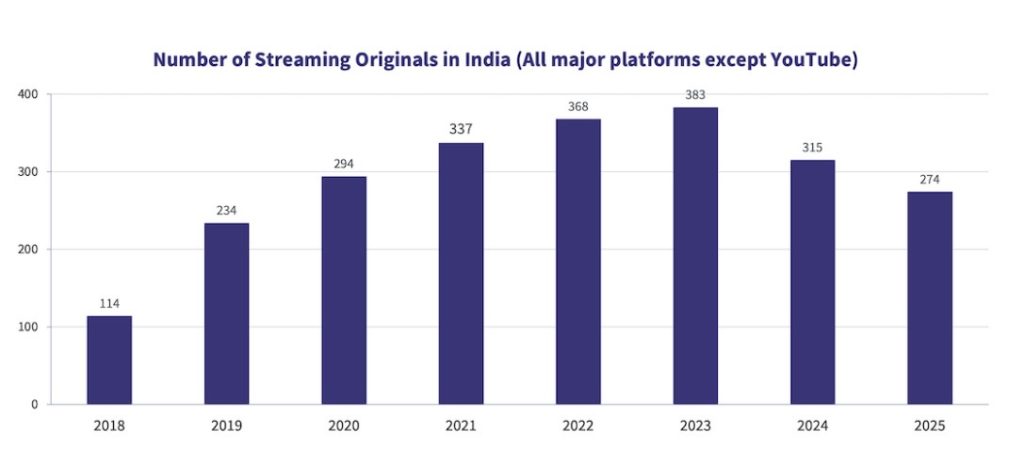

India’s over-the-top (OTT) streaming landscape saw original content supply contract for the second consecutive year in 2025, with total OTT originals dropping 13 percent from 2024 to under 300 titles — the lowest tally since 2020, according to the Ormax Media study ‘Supply trends: Indian streaming originals in 2025’.

The broader decline follows an 18 percent fall in 2024, signifying tightening content pipelines across major platforms.

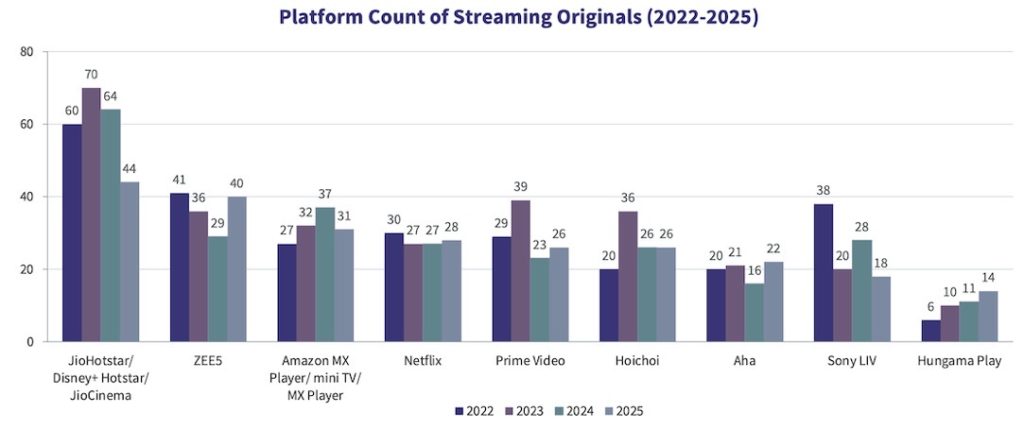

The study identifies industry consolidation and regulatory actions as key factors in the 2025 decline, notably the Disney+ Hotstar and JioCinema merger rationalising overlapping content slates, and the banning of prolific creator Ullu, which had contributed 17 originals in the prior year.

Despite the overall reduction, fiction series continued to dominate the OTT originals mix in 2025, accounting for around 71 percent of titles, reinforcing scripted long-form storytelling as the centrepiece of platform content strategies, according to Ormax.

The annual analysis, which tracks OTT original launches across major platforms in India (excluding YouTube), shows that language and format dynamics continue to evolve. Hindi remained the largest language cohort at roughly 60 percent of originals, though this represented a modest reduction from 65 percent in 2024. Meanwhile, Telugu originals grew in count compared with the previous year, signalling emerging regional momentum.

Platform-specific strategies varied across the ecosystem. Netflix maintained the most balanced format portfolio, with a mix of fiction and non-fiction types, while most other services skewed heavily towards scripted series and direct-to-OTT films. According to the study, fiction content remained the dominant format across virtually all platforms, underlining its ongoing appeal.

However, between fiction series and direct-to-OTT films, all platforms are in the 75-100 percent range, highlighting the continued dominance of scripted content in the streaming originals space in India.

The analysis is based on a count of streaming or OTT originals launched in India across all major platforms, excluding YouTube. Platforms covered in the analysis are: JioHotstar (including its predecessors Disney+ Hotstar and JioCinema), Netflix, Prime Video, Sony LIV, ZEE5, Amazon MX Player, Hoichoi, Aha, Sun NXT, Hungama Play, ETV Win, Ultra Jhakaas, Kilkk, Addatimes, and Discovery+. There are several other platforms (the most prominent of them being Stage) that are not covered in this analysis. Ormax hopes to widen the scope of this analysis next year to include more platforms.

As the OTT landscape continues to mature in 2026, the study suggests that platforms will likely focus on efficiency and targeted language diversification to drive deeper audience engagement, with possible growth in regional language originals in the next cycle.

(Image and charts courtesy Ormax Media)

India M&E looks for a place under AI sunshine as global meet starts

India M&E looks for a place under AI sunshine as global meet starts  Amazon Ads India head outlines 2026’s 5 brand-consumer connect trends

Amazon Ads India head outlines 2026’s 5 brand-consumer connect trends  IBDF & 14 industry bodies led multi-body coalition bats for consent-led AI copyright rules

IBDF & 14 industry bodies led multi-body coalition bats for consent-led AI copyright rules  JioStar VC Uday Shankar to deliver keynote at New Delhi AI Summit

JioStar VC Uday Shankar to deliver keynote at New Delhi AI Summit  ‘Yeh Jawaani Hai Deewani’ won’t have sequel, says Ranbir Kapoor

‘Yeh Jawaani Hai Deewani’ won’t have sequel, says Ranbir Kapoor  Ankuur Rajesh Kapila returns to ZEE5 as National Sales Head

Ankuur Rajesh Kapila returns to ZEE5 as National Sales Head  SPNI bags TV rights for Indian Super League 2025–26 season

SPNI bags TV rights for Indian Super League 2025–26 season  Mirchi launches ‘Jal Vaani’ with National Water Mission to promote conservation

Mirchi launches ‘Jal Vaani’ with National Water Mission to promote conservation