Reliance Industries Ltd (RIL) and Walt Disney Co. are finalising details of a non-binding term sheet to move ahead with plans to merge their India media and entertainment operations, said executives involved in the matter.

According to the Economic Times, the deal is likely to give the Mukesh Ambani-led group a controlling stake in what will become the country’s largest media and entertainment business if the deal goes through.

The plan, as of now, is to create a step-down subsidiary of RIL’s Viacom18, which will absorb Star India via a stock swap, said the people cited above. Reliance is pitching to be the larger shareholder with at least 51 percent in the merged company with Disney owning the residual 49 percent, they said. Both businesses are being treated as similar-sized ones, so RIL is likely to pay cash for the controlling stake.

The two sides are also negotiating a business plan to inject cash as immediate capital investment, expected to be $1-1.5 billion. The final shareholding structure of the entity will get crystallised and its value established based on the cash infusion from each of the parties.

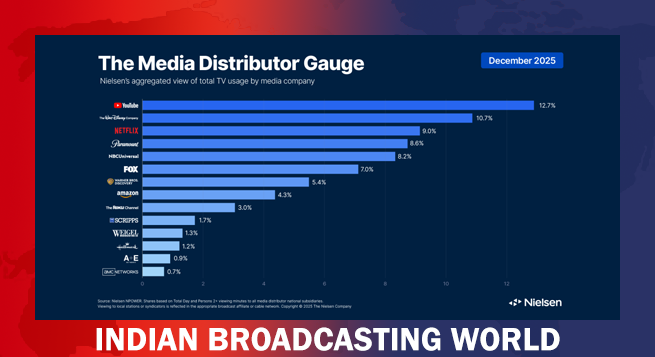

Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Collective Artists Network welcomes Rawal, Jain, Regulapati as partners

Collective Artists Network welcomes Rawal, Jain, Regulapati as partners  WaveX invites startups to apply for India AI Impact Summit 2026

WaveX invites startups to apply for India AI Impact Summit 2026  Five channels win slots in DD Free Dish 95th and 96th e-auctions

Five channels win slots in DD Free Dish 95th and 96th e-auctions  Palki Sharma exits Firstpost; Prabhakar named CCO

Palki Sharma exits Firstpost; Prabhakar named CCO  Z rolls out ‘Dilfluencer Moments’ to help brands cut through multi-screen clutter

Z rolls out ‘Dilfluencer Moments’ to help brands cut through multi-screen clutter