Japan’s premium video-on-demand (VOD) sector reached a significant milestone in 2025, expanding 15 percent year-on-year to reach US$7.2 billion in total revenue, according to a study by Media Partners Asia, which said yesterday the market is increasingly defined by layered monetization strategies

According to a media statement put out by the Singapore-based MPA, the Japanese market’s growth includes the expansion of ad-supported tiers and a strategic shift toward deeper local content, live events and sports.

The ‘Japan Online Video Consumer Insights & Analytics’ report was released yesterday by MPA and its proprietary measurement platform, AMPD.

The Japanese landscape remains highly concentrated, with three players (Netflix, Amazon Prime Video and U-Next) commanding 50 percent of total category revenue.

Netflix maintained its revenue leadership with a 22 percent share. Amazon Prime Video holds the largest subscriber base in Japan at 19.3 million, anchored to its ecosystem flywheel, integrating e-commerce, retail data, and video. U-Next, the leading domestic SVOD platform, captured 12 percent of category revenue. Its vertically integrated model, bundling video with manga, music, and exclusive sports coverage has created a defensible moat against global rivals.

The SVOD sector added 4 million net new subscribers in 2025, bringing the total (including YouTube Premium) to 67.9 million. Netflix led growth, fuelled by its November 2025 KDDI bundle renewal and breakout local originals. Other key contributors included DAZN, largely through zero-cost integration into NTT Docomo’s ahamo MAX plans. Disney+ and Hulu Japan grew their footprint through their joint bundle.

The premium VOD category generated 8.1 billion streaming hours in 2025. While TVer (the broadcaster-backed AVOD giant) maintained the largest share of viewing time at 23 percent, Netflix led per-user engagement with the average user spending close to 20 hours per month on the platform.

Japanese content remains the primary engagement pillar with 80 percent of total viewership. Anime is a critical driver with ‘Spy x Family’ the top title of Q4 2025. Live-Action dramas and variety dominated the AVOD landscape through TVer, while Netflix (‘Last Samurai Standing’) and Amazon (‘The Golden Combi’, ‘Love Transit’) contributed original hits. International content remains impactful; US series and movies reached 28 percent of users, led by tentpoles such as ‘Wicked’, ‘A Minecraft Movie’ and Netflix’s ‘Stranger Things’.

As the market matures, platforms are shifting focus toward high-impact event viewing. MPA said that Netflix will make a major foray into live sports by exclusively hosting the 2026 World Baseball Classic, TVer will expand its FTA lead by streaming select events from the 2026 Winter Olympics, and U-Next will continue its aggressive sports expansion with upcoming women’s golf majors and Premier League coverage (2025-28).

Dhivya T, Lead Analyst and Head of Insights at MPA, commented: “Japan’s premium VOD market has reached a critical maturation point. Growth is no longer just about net additions, but sophisticated monetization through ad-tier yields, telco bundling, and vertically integrated ecosystems. The entry of major players like Netflix into live sports and the continued dominance of local anime and drama suggest that the next phase of competition will hinge on event-driven engagement and premium local storytelling.”

Vaishnaw feels AI, creativity will co-exist; strong guardrails needed

Vaishnaw feels AI, creativity will co-exist; strong guardrails needed  India M&E looks for a place under AI sunshine as global meet starts

India M&E looks for a place under AI sunshine as global meet starts  Amazon Ads India head outlines 2026’s 5 brand-consumer connect trends

Amazon Ads India head outlines 2026’s 5 brand-consumer connect trends  IBDF & 14 industry bodies led multi-body coalition bats for consent-led AI copyright rules

IBDF & 14 industry bodies led multi-body coalition bats for consent-led AI copyright rules  ‘Tell Me Lies’ to end with Season 3, confirms showrunner

‘Tell Me Lies’ to end with Season 3, confirms showrunner  Amul celebrates Farhan’s Ravi Shankar Hollywood debut

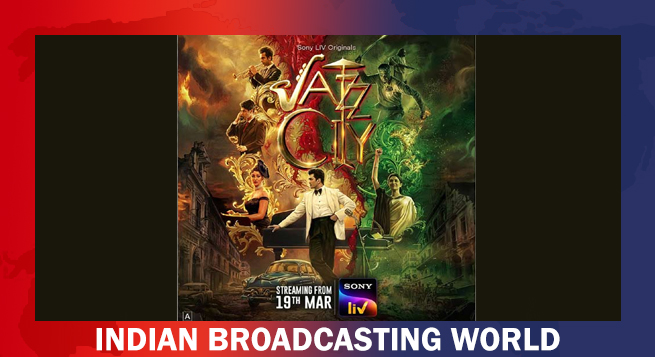

Amul celebrates Farhan’s Ravi Shankar Hollywood debut  ‘Jazz City’ trailer unveiled, set to stream on Sony LIV from March 19

‘Jazz City’ trailer unveiled, set to stream on Sony LIV from March 19  Pocket FM’s creator economy crosses Rs.300cr, targets Rs.1,000cr by 2026

Pocket FM’s creator economy crosses Rs.300cr, targets Rs.1,000cr by 2026  Trailer of ‘Secret Stories: Roslin’ unveiled, series to premiere Feb 27

Trailer of ‘Secret Stories: Roslin’ unveiled, series to premiere Feb 27