At a time when the global economy is grappling with geopolitical uncertainty, rapid technological change and shifting capital flows, two of the world’s most influential business leaders — Mukesh Ambani, Chairman and Managing Director of Reliance Industries Limited, and Larry Fink, Chairman and Chief Executive Officer of BlackRock — will come together for an exclusive conversation on CNBC TV18 today.

The interaction, which is part of a press release issued on February 4, will see Ambani and Fink in discussion with Shereen Bhan, Managing Editor of CNBC TV18. The conversation is scheduled to air from 3pm onwards and is expected to offer rare, forward-looking perspectives on how investing and capital allocation are evolving in India amid a rapidly changing global order.

The dialogue brings together two leaders who are shaping the future of business and finance at scale. Reliance Industries continues to play a pivotal role in India’s energy transition, digital infrastructure expansion and consumer-led growth, while BlackRock, the world’s largest asset manager, oversees more than $14 trillion in assets globally. Against this backdrop, the conversation is likely to explore how long-term capital is being deployed to navigate disruption and unlock growth in emerging and developed markets alike.

Larry Fink’s appearance on CNBC TV18 coincides with his third visit to India, underscoring the country’s growing strategic importance for BlackRock. The Wall Street-listed firm, with a market capitalisation of over $177 billion, has steadily deepened its engagement with India. Fink had previously visited the country twice in 2023, including an October visit during which he met both Mukesh Ambani and Prime Minister Narendra Modi in New Delhi.

India has emerged as a cornerstone of BlackRock’s long-term growth strategy, anchored by its joint venture with Jio Financial Services. In July 2023, the two partners announced the formation of JioBlackRock, a 50:50 venture, with a commitment of up to $150 million each to build a digital-first asset management platform aimed at India’s rapidly expanding investor base.

The timing of the conversation is also significant given BlackRock’s strong global performance. The firm closed 2025 with record assets under management of $14.04 trillion, driven by net inflows of $698 billion during the year, including $342 billion in the fourth quarter alone. Fink has consistently highlighted India as a standout destination for global capital, citing structural reforms, a growing consumer economy and compelling long-term return potential.

Speaking at the Saudi–US Investment Summit in Riyadh last year, Fink had observed that the “fog of global uncertainty is lifting,” with capital increasingly flowing back into dynamic markets such as India. That sentiment is expected to form a key part of the CNBC TV18 discussion, as the two leaders reflect on access to capital, the role of technology and the ways in which investment can support sustainable economic growth.

As geopolitical shifts continue to reshape trade, capital allocation and economic alliances, the CNBC TV18 conversation between Mukesh Ambani and Larry Fink promises to go beyond balance sheets, offering clarity and strategic insight at a defining moment for both India and the global economy.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Fourth Dimension Media Solutions marks 15 years of industry leadership

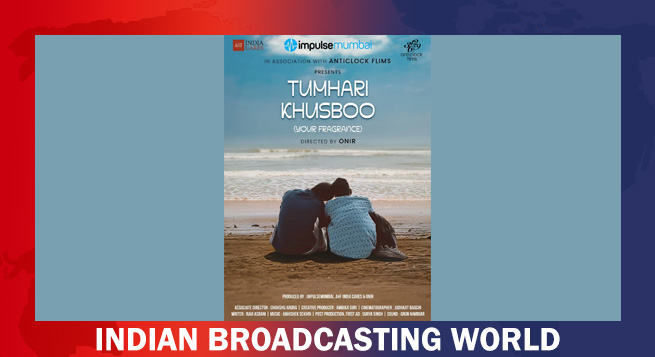

Fourth Dimension Media Solutions marks 15 years of industry leadership  Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’

Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’  Ananya Birla forays into cinema with launch of Birla Studios

Ananya Birla forays into cinema with launch of Birla Studios  Travelxp launches HD/4K on Makedonski Telekom in Balkans

Travelxp launches HD/4K on Makedonski Telekom in Balkans  India Today Group named exclusive media partner for WGS Dubai

India Today Group named exclusive media partner for WGS Dubai