The combined global online video and traditional TV markets, including revenue from subscriptions, on-demand transactions and advertising, are on track to reach $1 trillion in annual revenue by 2030.

The findings come from two new Omdia reports: Global Streaming: Key trends 2025–30 and Pay TV & Online Video: Global.

With pay TV flat, all of the growth is coming from online video. Global video streaming revenue is expected to reach $214.6 billion in 2025, representing an annual growth rate of 12.8b percent. Online video subscription revenue will account for 77 percent of the total, Omdia said late last week in a press release.

Premium advertising revenue — whether via hybrid SVOD/AVOD, native AVOD, FAST or broadcaster streaming TV services — is projected to total $42.1 billion worldwide, an increase of 15.6 percent over 2024.

Adam Thomas, Practice Leader at Omdia, said: “These two reports show that while traditional pay TV is declining globally, this is happening slowly. Pay TV will continue to contribute substantial revenue for many years. Combined with strong, ongoing growth in online video, this creates a highly positive scenario and leads Omdia to forecast that the two markets together will top $1 trillion in revenue by 2030.”

Tony Gunnarsson, Principal Analyst at Omdia, said: “Streaming remains primarily a subscription business, and in 2025 the total number of paid subscriptions continues to grow steadily. But there is a wake-up call ahead: through to 2030, the market will keep expanding but lower annual growth rates are expected for premium streaming, reflecting that streaming has reached mass-market penetration globally.”

Gunnarsson added, “It is still early days for hybrid video. While streaming stays largely a subscription-focused business for the foreseeable future, the shift to include advertising tiers has paid off handsomely.”

The new Omdia research finds that advertising’s role — for both SVOD and streaming overall — will continue to grow through 2030. By that year, advertising revenue from the combined “big five” US SVOD services (Netflix, Amazon, Disney, HBO Max and Paramount) is projected to reach $24.3 billion, or 20 percent of the combined revenue up from 13 percent in 2025.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Fourth Dimension Media Solutions marks 15 years of industry leadership

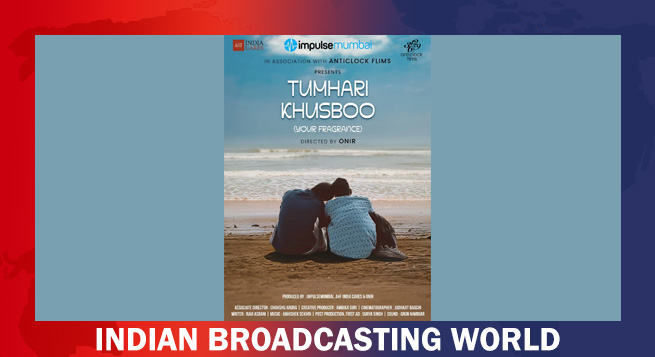

Fourth Dimension Media Solutions marks 15 years of industry leadership  Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’

Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’  Ananya Birla forays into cinema with launch of Birla Studios

Ananya Birla forays into cinema with launch of Birla Studios  Travelxp launches HD/4K on Makedonski Telekom in Balkans

Travelxp launches HD/4K on Makedonski Telekom in Balkans  India Today Group named exclusive media partner for WGS Dubai

India Today Group named exclusive media partner for WGS Dubai