India’s Tata Group and Bharti Group are close to merging their satellite TV businesses, creating a nearly $1.6 billion entity with the aim of tiding over the sustained migration of subscribers to digital streaming, Reuters quoted an Economic Times as saying yesterday.

The merged entity is expected to be run by Bharti Airtel, which will likely hold between 52-55 percent with the remaining held by Tata Play shareholders, including Walt Disney, the report said, citing sources. (https://www.reuters.com/markets/deals/indias-tata-play-airtel-digital-tv-near-merger-et-reports-2025-02-25/)

Bharti Airtel, Tata Play and Disney did not immediately respond to Reuters requests for comments.

Tata Play — a 70:30 venture between Tata Sons and Disney — and Airtel had a combined 35 million paid subscribers as of last September, more than half the 60 million subscribers industry-wide at the time, according to a government report.

The two businesses are being approximately valued between Rs. 60 billion ($690.76 million)-Rs. 70 billion ($805.89 million) each, with their revenue exceeding Rs. 70 billion in fiscal 2024, ET reported.

The deal is the second major one in the sector since Dish TV with Videocon d2h in 2016 and follows the $ 8.5 billion merger of Reliance Industries non-news media assets with Disney’s Indian media assets last year.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Fourth Dimension Media Solutions marks 15 years of industry leadership

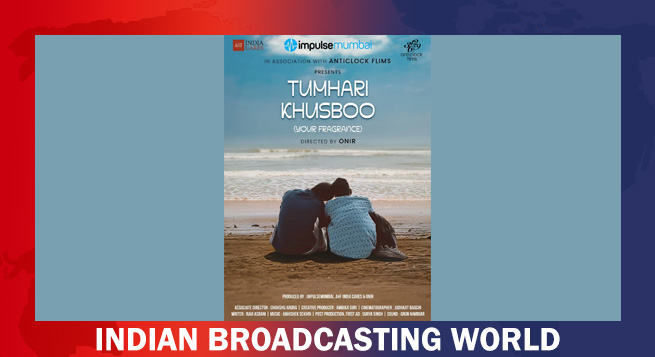

Fourth Dimension Media Solutions marks 15 years of industry leadership  Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’

Barun Sobti to headline Onir’s upcoming film ‘Tumhari Khushboo’  Ananya Birla forays into cinema with launch of Birla Studios

Ananya Birla forays into cinema with launch of Birla Studios  Travelxp launches HD/4K on Makedonski Telekom in Balkans

Travelxp launches HD/4K on Makedonski Telekom in Balkans  India Today Group named exclusive media partner for WGS Dubai

India Today Group named exclusive media partner for WGS Dubai