The Indian telecom sector, boasting a robust subscriber base of 1.2 billion, is making significant strides in adopting Artificial Intelligence (AI) and exploring 6G technologies to redefine connectivity standards. The sector’s growth story has been extraordinary, with the average monthly wireless data usage per user skyrocketing to 21.30 GB by October 2024, as per the Cellular Operators Association of India (COAI), ANI reported from New Delhi.

India’s telecom advancements are fueled by the rapid deployment of 5G infrastructure, with over 460,592 5G BTS sites operational nationwide. This infrastructure has already propelled 5G adoption to exceed 125 million users, with projections indicating a surge to 350 million users by 2026. One of the standout use cases is Fixed Wireless Access (FWA), which has reached a milestone of nearly 3 million connections in just a year.

The industry is at the forefront of technological innovation, leveraging AI across operational and customer-centric domains. According to KPMG India, over 55 percent of Technology, Media, and Telecommunications (TMT) companies in India have already integrated AI, while 37 percent are in the process of scaling its application. Further, the government’s Bharat 6G Vision initiative seeks to position India as a global leader by targeting 10 percent of global 6G patents, backed by funding for advanced testbeds and ecosystem research.

Despite its remarkable achievements, the telecom industry faces several critical challenges. Large Traffic Generators (LTGs), such as video streaming platforms, place immense pressure on networks, compelling Telecom Service Providers (TSPs) to invest ₹10,000 crore in 2023 alone. However, the absence of LTG contributions has resulted in an ₹800 crore loss to the Indian exchequer in Adjusted Gross Revenue (AGR) dues and taxes.

Another major concern stems from the unregulated operations of Over-the-Top (OTT) communication platforms. Unlike TSPs, these platforms are not bound by stringent security and privacy norms, creating disparities in the ecosystem. COAI has called for the enforcement of uniform regulations to address traceability and privacy concerns.

The 6 GHz spectrum band, crucial for seamless 5G rollouts, remains a priority for immediate allocation to mobile networks. Additionally, unauthorized sales of Wi-Fi 6E routers online and Right of Way (RoW) challenges hinder infrastructure expansion. The newly proposed Quality of Service (QoS) norms by the Telecom Regulatory Authority of India (TRAI) have also drawn criticism from TSPs for being impractical under current conditions.

Government initiatives, such as the abolition of the Wireless Operating License (WOL) and waivers on bank guarantees for deferred spectrum payments, have provided much-needed relief to the sector. A recent Supreme Court ruling granting tax credits for telecom tower components has further alleviated financial pressures.

To ensure equitable growth, COAI recommends extending Unsolicited Commercial Communication (UCC) regulations to OTT services, streamlining spectrum auctions, and integrating Direct-to-Mobile (D2M) broadcasting with telecom networks instead of creating standalone broadcasting setups.

A Connected Future

India’s telecom sector stands at the cusp of a technological revolution, driven by innovation, strategic policies, and growing consumer demand. However, addressing the challenges of regulatory disparities, infrastructure constraints, and spectrum allocation is crucial for sustaining its growth momentum. As the sector forges ahead, the focus remains on creating a fair and inclusive ecosystem while cementing India’s position as a global telecom leader.

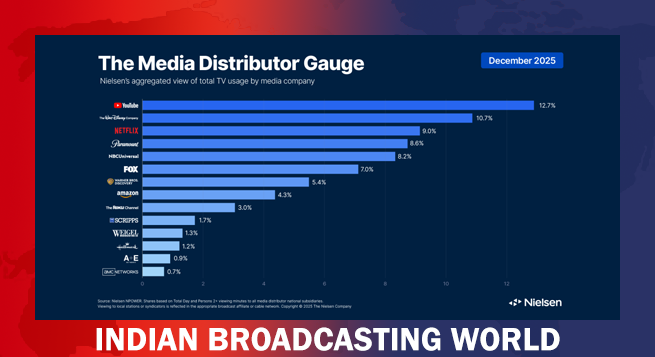

Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Sagar Gonsalvez joins JioHotstar as associate director, performance sales – sports

Sagar Gonsalvez joins JioHotstar as associate director, performance sales – sports  SPNI appoints Harsh Sheth as Business Head of SET

SPNI appoints Harsh Sheth as Business Head of SET  Mihir Palan elevated to Associate VP at WPP Media, APAC

Mihir Palan elevated to Associate VP at WPP Media, APAC  Imtiaz Ali–Diljit Dosanjh film set for June 12, 2026 theatrical release

Imtiaz Ali–Diljit Dosanjh film set for June 12, 2026 theatrical release