Zee Entertainment Enterprises Ltd. (ZEEL) has received the green light from its shareholders to raise up to Rs 2,000 crore through the issuance of securities, the company announced in a filing to the stock exchanges on Monday. The resolution saw significant support, with 78.83 percent of the votes cast in favor and 21.16 percent against, IANS reported.

The announcement came after market hours, with ZEEL’s stock closing at Rs 160.34 on the NSE on Monday, marking a 3.11 percent increase from Friday’s closing price of Rs 155.50.

Despite the recent uptick, ZEEL shares have struggled over the past year, experiencing a decline of over 30 percent. The year-to-date correction has been even steeper at 44%. This decline has been largely attributed to the fallout from the failed merger deal with Sony Group.

In January, Sony Group withdrew from its agreement to merge its India operations with Zee, ending a two-year-old plan aimed at creating a $10 billion media giant. Sony’s decision to terminate the merger, citing Zee’s failure to meet merger agreement conditions, included a demand for $90 million in break-up fees. Zee denied any breach of the pact announced in December 2021.

The company has also faced leadership turbulence, with the termination of Zee Media Corporation Ltd. (ZMCL) CEO Abhay Ojha in May. The reasons for his termination were not disclosed, adding to the company’s challenges.

The approved Rs 2,000 crore fundraising via securities issuance is seen as a strategic move to bolster the company’s financial position amid these challenges. Zee Entertainment plans to utilize the funds to strengthen its balance sheet, support ongoing projects, and explore new growth opportunities.

Market analysts are closely watching how Zee will leverage the new capital. The company’s ability to regain investor confidence and stabilize its stock price will be crucial in the coming months. The successful implementation of this fundraising initiative could signal a positive turn for the embattled media giant.

A spokesperson for Zee Entertainment expressed optimism about the approval, stating, “The shareholder nod to raise Rs 2,000 crore is a pivotal step in our strategic plan to navigate current challenges and fuel our future growth. We are committed to creating long-term value for our shareholders and stakeholders.”

The recent shareholder approval and subsequent stock price rise indicate a cautiously optimistic investor sentiment. However, the company’s performance in the aftermath of the failed merger and leadership changes will be critical in determining its trajectory.

As Zee Entertainment embarks on this new chapter, the industry will be watching closely to see how the company maneuvers through its current hurdles and capitalizes on new opportunities in the rapidly evolving media landscape.

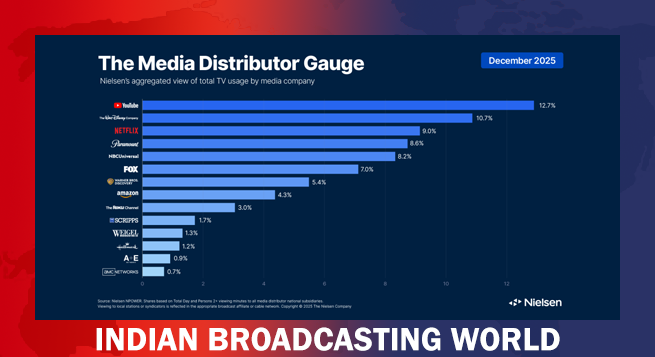

Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Sagar Gonsalvez joins JioHotstar as associate director, performance sales – sports

Sagar Gonsalvez joins JioHotstar as associate director, performance sales – sports  SPNI appoints Harsh Sheth as Business Head of SET

SPNI appoints Harsh Sheth as Business Head of SET  Mihir Palan elevated to Associate VP at WPP Media, APAC

Mihir Palan elevated to Associate VP at WPP Media, APAC  Imtiaz Ali–Diljit Dosanjh film set for June 12, 2026 theatrical release

Imtiaz Ali–Diljit Dosanjh film set for June 12, 2026 theatrical release