Lionsgate Entertainment Corp shares jumped last week in the US after the company said it’s likely to announce a deal to spin off or sell a piece of its Starz cable network in September, with potential partners also showing interest in the company’s film and TV studios.

Shares surged 11 percent in New York, valuing the media company at about $billion, a Bloomberg report said.

Lionsgate has been working with advisers this year to sell a stake in Starz, known for shows like ‘Power’ and ‘Outlander’. Executives have argued that Wall Street is undervaluing the company in its current structure. Lions Gate is one of the last remaining independent studios after tech giants and larger companies snapped up its competitors.

“The structure that we’re considering has become broader,” Lionsgate Vice Chairman Michael Burns said on an earnings call last Thursday, adding, “As always, our priority is to create significant shareholder value.”

Lionsgate Chief Executive Officer Jon Feltheimer said his team was planning to “keep our head down” and focus on making good movies and TV shows.

Lionsgate reported earnings for the first fiscal quarter of 2023 that came close to analyst estimates. It generated $893.9 million in revenue, just short of Wall Street expectations.

The company’s film studio is known for productions like ‘Knives Out’ and the ‘John Wick’ series.

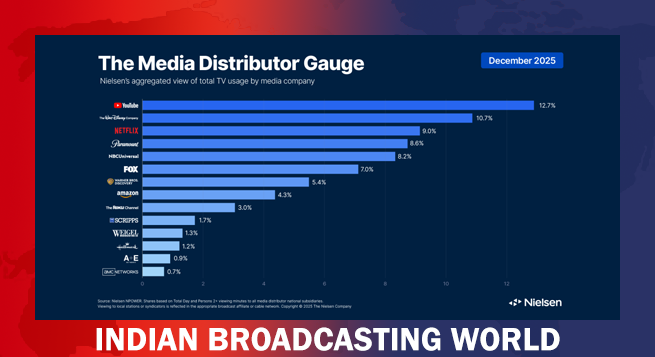

Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Sagar Gonsalvez joins JioHotstar as associate director, performance sales – sports

Sagar Gonsalvez joins JioHotstar as associate director, performance sales – sports  SPNI appoints Harsh Sheth as Business Head of SET

SPNI appoints Harsh Sheth as Business Head of SET  Mihir Palan elevated to Associate VP at WPP Media, APAC

Mihir Palan elevated to Associate VP at WPP Media, APAC  Imtiaz Ali–Diljit Dosanjh film set for June 12, 2026 theatrical release

Imtiaz Ali–Diljit Dosanjh film set for June 12, 2026 theatrical release