Netflix capped last year with another solid financial performance despite slowing subscriber growth that underscored the importance of its contested $72 billion bid to take over Warner Bros.’ movie studio and slot HBO Max into its video streaming line-up.

The fourth-quarter results announced on January 20 eclipsed the projections of stock market analysts, but Netflix’s report also noted that the video service ended the year with more than 325 million worldwide subscribers, a figure indicating it has added about 23 million subscribers since 2024.

The 2025 subscriber increase marked a dramatic slowdown from the 41 million picked up during 2024, amplifying investor worries that Netflix’s growth has peaked since the 2022 introduction of a low-priced, advertising-supported version of its service that triggered a massive surge in subscribers.

Management also forecast a profit for the January-March period that was below analysts’ predictions and announced Netflix would stop buying back its own stock while trying to complete the Warner Bros’ deal. Even though its ad sales are expected to double, Netflix also projected its revenue growth would taper off from 16 percent in 2025 to 12 percent to 14 percent this year.

“Overall, this points to a challenging start to the year,” said Investing.com analyst Thomas Monteiro.

Netflix’s shares sank nearly 5 percent in extended trading, even though its profit and revenue for the past quarter were better than anticipated. The company earned $2.4 billion, or 56 cents per share, 29 percent increase from the same time in the previous year. Revenue rose 18 percent from the previous year to more than $12 billion.

The results almost seemed like a footnote next to the stakes involved in Netflix’s bidding war to buy Warner Bros. Discovery .

Although Warner Bros. has reiterated its commitment to getting the Netflix deal done, Paramount isn’t showing any signs of backing down and could still sweeten its counteroffer to turn up the heat another notch.

Netflix co-CEO Ted Sarandos seemed to send a warning shot across Paramount’s bow during a Tuesday conference call as he recalled fending off rivals such as Walmart and the now-vanquished Blockbuster video chain during the company’s days as a DVD-by-mail rental service. “We are no strangers to competition and we are now strangers to change,” Sarandos said.

Besides having to fend off Paramount, Netflix will also need to persuade U.S. regulators that adding HBO to a streaming service that has the most subscribers in the country won’t stifle competition and drive up prices that have already been rising in recent years.

The uncertainty has been reflected in Netflix’s stock price, which has fallen by 20% since its agreement with Warner Bros. Discovery was unveiled last month. It’s a cloud likely to hang over Netflix through most of this year because the company doesn’t expect to complete its purchase until Warner Bros. Discovery spins off its cable TV business — a process expected to take six to nine months.

“We are energized as ever to achieve our mission to entertain the world,” Sarandos said.

India–England T20 WC semi-final sets global streaming record on JioHotstar

India–England T20 WC semi-final sets global streaming record on JioHotstar  Meta pushes back against Karnataka SM ban for kids under 16

Meta pushes back against Karnataka SM ban for kids under 16  Netflix boosts Ads Suite with new tech tools to up experiences

Netflix boosts Ads Suite with new tech tools to up experiences  T20 World Cup 2026 crosses 500 mn viewers in India: Jay Shah

T20 World Cup 2026 crosses 500 mn viewers in India: Jay Shah  FY26 Q3 pay TV viewership dips; telecom subs, revenues up: TRAI

FY26 Q3 pay TV viewership dips; telecom subs, revenues up: TRAI  MRSI honours top researchers at 7th Golden Key Awards in Mumbai

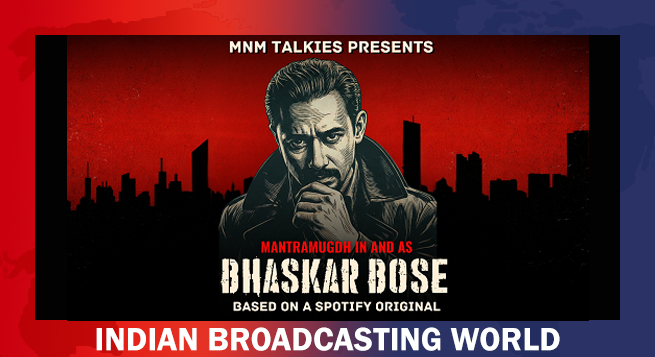

MRSI honours top researchers at 7th Golden Key Awards in Mumbai  ‘Bhaskar Bose’ returns as MnM Talkies revives hit detective podcast

‘Bhaskar Bose’ returns as MnM Talkies revives hit detective podcast  Ranveer’s fierce dual roles in ‘Dhurandhar: The Revenge’ trailer

Ranveer’s fierce dual roles in ‘Dhurandhar: The Revenge’ trailer  Ryan Gosling’s ‘Project Hail Mary’ to hit Indian theatres on March 26

Ryan Gosling’s ‘Project Hail Mary’ to hit Indian theatres on March 26