Netflix and Warner Bros. Discovery (WBD) have announced a definitive agreement under which Netflix will acquire Warner Bros., along with its film and television studios, HBO and HBO Max, following the planned separation of WBD’s Global Networks division, Discovery Global.

According to a joint announcement, the cash-and-stock deal values the transaction at an enterprise value of $82.7 billion and an equity value of $72 billion, pricing each WBD share at $27.75. The acquisition is expected to close after Discovery Global becomes a separately listed company in Q3 2026.

The combination brings together some of the world’s most influential storytelling powerhouses, uniting Netflix’s global streaming dominance with the century-long legacy of Warner Bros., whose library includes iconic titles such as ‘The Big Bang Theory’, ‘The Sopranos’, ‘Game of Thrones’, ‘Casablanca’, ‘Harry Potter’ and the DC Universe. These will join Netflix’s hit franchises including ‘Stranger Things’, ‘Money Heist’, ‘Wednesday’ and ‘Bridgerton’, setting the stage for what industry observers say could become the world’s most robust entertainment ecosystem.

Netflix co-CEO Ted Sarandos said the merger aligns with the company’s long-held mission “to entertain the world,” noting that combining Warner Bros.’ classics with Netflix’s global cultural hits would “help define the next century of storytelling.” His fellow co-CEO Greg Peters added that the acquisition significantly strengthens the company’s production capabilities and global footprint, giving members “more options and more worlds to discover.”

WBD President and CEO David Zaslav called the announcement a union of “two of the greatest storytelling companies in the world,” emphasizing that Warner Bros.’ legacy would reach an even broader audience under the combined banner.

The companies expect the merger to expand value for subscribers by offering a larger and more diverse content library, enhance Netflix’s production capacity in the U.S., and create more opportunities for creators to work across beloved intellectual properties. Netflix anticipates $2–3 billion in cost savings by the third year of the merger and expects the deal to become accretive to GAAP earnings per share by year two.

Under the agreed terms, each WBD shareholder will receive $23.25 in cash and $4.50 in Netflix stock per WBD share, with a collar mechanism to account for fluctuations in Netflix’s stock price prior to closing. The deal has been unanimously approved by both boards but remains subject to regulatory approvals, shareholder clearance and the completion of WBD’s corporate separation.

Financial advisors on the deal include Moelis & Company for Netflix and Allen & Company, J.P. Morgan and Evercore for WBD, with leading international law firms handling the legal advisory.

If closed as planned within 12–18 months, the acquisition would cement Netflix’s position as the world’s most influential content company, marking a landmark shift in the global entertainment landscape.

Netflix to acquire WBD for total enterprise value of $82.7bn

Netflix to acquire WBD for total enterprise value of $82.7bn  Madras HC halts release of ‘Akhanda 2’ in major relief for Eros International

Madras HC halts release of ‘Akhanda 2’ in major relief for Eros International  Kevin Vaz highlights India’s content surge at Asia TV Forum 2025

Kevin Vaz highlights India’s content surge at Asia TV Forum 2025  Gaurav Gandhi honored as M&E visionary at CII Summit 2025

Gaurav Gandhi honored as M&E visionary at CII Summit 2025  Ministry of Tourism signs MoU with Netflix to showcase India’s destinations globally

Ministry of Tourism signs MoU with Netflix to showcase India’s destinations globally  GTPL Hathway unveils ‘GTPL Infinity’, new satellite-based HITS platform

GTPL Hathway unveils ‘GTPL Infinity’, new satellite-based HITS platform  JioHotstar teases ‘South Unbound’, signals new creative phase

JioHotstar teases ‘South Unbound’, signals new creative phase  Prime Video India unpacks trends at CII Big Picture Summit

Prime Video India unpacks trends at CII Big Picture Summit  Prime Video’s Nikhil Madhok calls for homegrown superhero in Indian streaming

Prime Video’s Nikhil Madhok calls for homegrown superhero in Indian streaming  Prime Video drops new posters for ‘Spider-Noir’ series

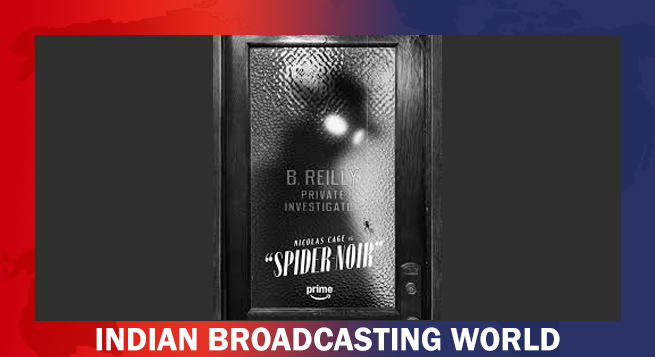

Prime Video drops new posters for ‘Spider-Noir’ series