Netflix has switched to an all-cash offer for Warner Bros Discovery’s studio and streaming assets without increasing the $82.7 billion price in a bid to shut the door on Paramount’s rival efforts to snag the Hollywood giant. The new all-cash bid — at $27.75 a share — has unanimous support from the HBO owner’s board, according to a regulatory filing yesterday in the US.

“Our revised all-cash agreement will enable an expedited timeline to a stockholder vote and provide greater financial certainty,” Netflix co-CEO Ted Sarandos said in a statement, according to a Reuters report.

Both Netflix and Paramount Skydance covet Warner Bros for its leading film and television studios, extensive content library and major franchises such as ‘Game of Thrones’, ‘Harry Potter’ and DC Comics’ superheroes ‘Batman’ and ‘Superman’.

Paramount has altered its terms and engaged in an aggressive media campaign to try to convince shareholders that its bid is superior, but Warner Bros has spurned the David Ellison-led company.

Warner Bros will hold a special investor meeting to vote on the Netflix deal, with the streaming pioneer saying that the meeting was expected to be held by April.

Netflix shares have fallen almost 15 percent since announcing the merger on December 5. The new $27.75-per-share offer from Netflix replaces its earlier cash-and-stock bid for $23.25 in cash and $4.50 in Netflix stock.

“The merger consideration is a fixed cash amount to be paid by an investment-grade company, providing (Warner Bros) stockholders with certainty of value and liquidity immediately upon closing the merger,” Warner Bros said.

The company’s board also disclosed its valuation for Discovery Global, a planned spin-off that will contain television assets including CNN and TNT Sports and the Discovery+ streaming service.

The board has maintained that the Netflix merger deal is superior to Paramount Skydance’s $30-per-share cash bid for the company because Warner Bros’ investors would retain a stake in the separately traded Discovery Global.

The rival bidder went to court on January 12 to expedite the disclosure of this information, so investors could evaluate the competing offers for Warner Bros. A Delaware court judge rejected the request, finding that Paramount had failed to demonstrate it would suffer irreparable harm from the alleged inadequate disclosures about Warner Bros’ cable TV business.

Paramount Skydance, whose tender offer expires on January 21, did not immediately respond to a Reuters request for comment.

India–England T20 WC semi-final sets global streaming record on JioHotstar

India–England T20 WC semi-final sets global streaming record on JioHotstar  Meta pushes back against Karnataka SM ban for kids under 16

Meta pushes back against Karnataka SM ban for kids under 16  Netflix boosts Ads Suite with new tech tools to up experiences

Netflix boosts Ads Suite with new tech tools to up experiences  T20 World Cup 2026 crosses 500 mn viewers in India: Jay Shah

T20 World Cup 2026 crosses 500 mn viewers in India: Jay Shah  FY26 Q3 pay TV viewership dips; telecom subs, revenues up: TRAI

FY26 Q3 pay TV viewership dips; telecom subs, revenues up: TRAI  MRSI honours top researchers at 7th Golden Key Awards in Mumbai

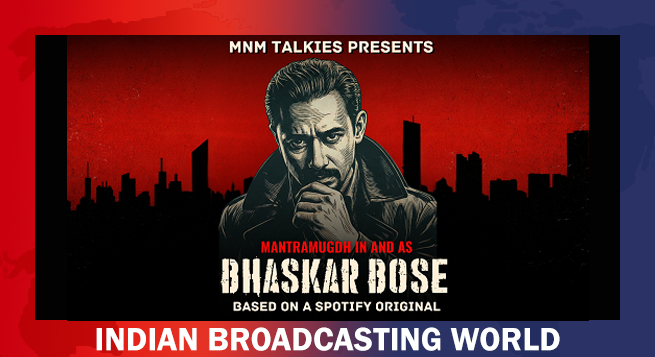

MRSI honours top researchers at 7th Golden Key Awards in Mumbai  ‘Bhaskar Bose’ returns as MnM Talkies revives hit detective podcast

‘Bhaskar Bose’ returns as MnM Talkies revives hit detective podcast  Ranveer’s fierce dual roles in ‘Dhurandhar: The Revenge’ trailer

Ranveer’s fierce dual roles in ‘Dhurandhar: The Revenge’ trailer  Ryan Gosling’s ‘Project Hail Mary’ to hit Indian theatres on March 26

Ryan Gosling’s ‘Project Hail Mary’ to hit Indian theatres on March 26