Nielsen is being acquired for $16 billion, including debt, about a week after the media measurement company rejected a $9 billion offer.

Nielsen Holdings plc. on Tuesday announced that it has entered into a definitive agreement to be acquired by a private equity consortium led by Evergreen Coast Capital Corporation, an affiliate of Elliott Investment Management L.P., and Brookfield Business Partners L.P. together with institutional partners for $28 per share in an all-cash transaction.

Viewing data collected by Nielsen plays a big role in determining where billions in advertising dollars are spent each year. The company itself has annual global revenue of about $3.5 billion, AP reported.

The Nielsen Board of Directors voted unanimously to support the acquisition proposal, which represents a 10 percent premium over the consortium’s previous proposal and a 60 percent premium over Nielsen’s unaffected stock price as of March 11, 2022, the last trading day before market speculation regarding a potential transaction.

“After a thorough assessment, the Board determined that this transaction represents an attractive outcome for our shareholders by providing a cash takeout at a substantial premium, while supporting Nielsen’s commitment to our clients, employees and stakeholders. The Consortium sees the full potential of Nielsen’s leadership position in the media industry and the unique value we deliver for our clients worldwide,” said James A. Attwood, Chairperson of Nielsen’s Board of Directors, in a statement.

Brookfield Business Partners will invest approximately $2.65 billion via preferred equity, convertible into 45 percent of Nielsen’s common equity. The equity version of the deal is worth just over $10 billion, with the remainder in debt held by Nielsen.

Brookfield said Tuesday that it anticipates investing approximately $600 million, with the remaining balance funded from institutional partners.

Nielsen Holdings Plc, based in New York City, turned down the group’s earlier, saying it had significantly undervalued the business. After it accepted the revised offer, shares of Nielsen jumped 22 percent at the opening bell.

Nielsen has come under criticism for failing to create new methods of capturing the amount of time people spend watching streaming services, such as Netflix or Hulu. It has become a much more complex task as people now load content onto phones, tablets and other smart devices.

Nielsen is attempting to address those complaints and is expected to launch a new cross-media measurement tool by the end of the year.

Nielsen One, according to the company, can deliver more comparable and comprehensive metrics across platforms ranging from traditional televisions to a host of other digital and streaming services.

According to Managing Partner Jesse Cohn and Senior Portfolio Manager Marc Steinberg on behalf of Evergreen and Elliott, “After months of deep market analysis, industry diligence and management reviews, we are firmly convinced that Nielsen will continue to be the gold standard for audience measurement as it executes on the Nielsen ONE roadmap.

“Having first invested in Nielsen nearly four years ago, we have a unique appreciation for the Company’s ongoing relevance to the global, digital-first media ecosystem. Today’s outcome represents a significant win for Nielsen’s shareholders and for the business itself, as our multibillion-dollar investment will help Nielsen reinforce its transformation at this critical inflection point. We are pleased to partner with David and the existing management team to lead Nielsen after the transaction is completed.”

However, there is a 45 day go-shop period during which Nielsen can look at and accept other offers, but breaking the agreement with the private equity group comes with a $102 million termination fee.

The deal is expected to close in the second half of this year. It still needs approval from Nielsen shareholders and regulators.

CCI okays Airtel’s acquisition of Warburg Pincus DTH stake

CCI okays Airtel’s acquisition of Warburg Pincus DTH stake  NDTV Marathi, 6th news channel from the stable, launched

NDTV Marathi, 6th news channel from the stable, launched  Korea Creative Content Agency to hold content expo in Sept

Korea Creative Content Agency to hold content expo in Sept  Andhra’s political clash: Naidu, Kalyan vs. Reddy

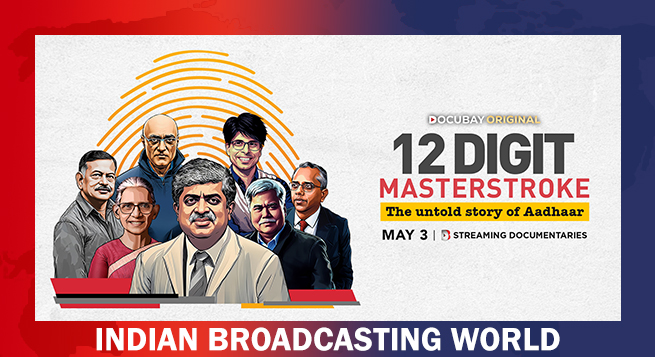

Andhra’s political clash: Naidu, Kalyan vs. Reddy  DocuBay releases ‘12 Digit Masterstroke’

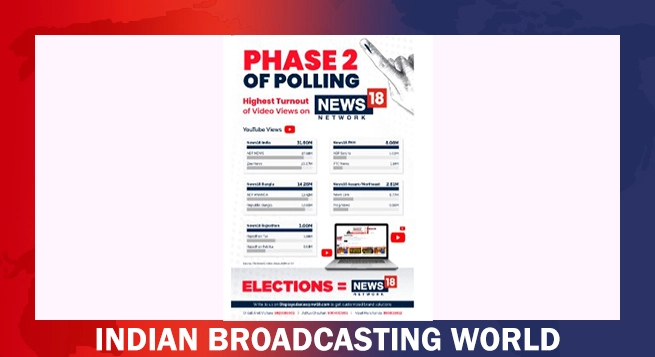

DocuBay releases ‘12 Digit Masterstroke’  News18 Network dominates YouTube views during second phase of Lok Sabha elections

News18 Network dominates YouTube views during second phase of Lok Sabha elections  NueGo teams up with T-Series’ ‘SRIKANTH’

NueGo teams up with T-Series’ ‘SRIKANTH’  Prime Video announces premiere date for ‘Panchayat’ S3

Prime Video announces premiere date for ‘Panchayat’ S3