Culver Max Entertainment Private Limited has surrendered the permissions given by Indian authorities to downlink AXN and AXN HD television channels.

The Indian government, while acceding to the surrender request, has also directed distribution platforms to refrain from carrying the two TV channels on their platforms, according to an advisory on Thursday.

In a letter earlier this week to the company, which also manages other Sony-branded TV channels and a streaming platform in India, the Ministry of Information and Broadcasting (MIB) said the two TV channels have been “deleted from the list of permitted private satellite TV channels in India” as desired by the company managing the affairs of the TV channels.

Cable Television Network Rules specify that cable operators or MSOs shall not carry or include on their cable services any television broadcast or channel that has not been registered by the central or federal government for being viewed within the territory of India.

Citing relevant regulation, MIB advisory stated, “A1l the MSOs/LCOs are hereby directed not to downlink the above-mentioned channel on their network, failing which appropriate/suitable action will be initiated against the defaulter(s).”

Indianbroadcastingworld.com, however, could not ascertain independently the reason behind surrender of downlink permissions given to AXN, which debuted in India in the decade of 2000. The HD version of the action channel was introduced a few years later.

Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

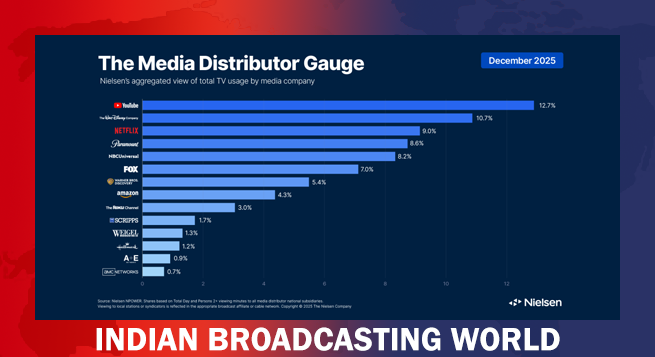

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  KRAFTON India launches BGMI Career Mode

KRAFTON India launches BGMI Career Mode  Spotify promotes Citra Marina as marketing head for SE Asia

Spotify promotes Citra Marina as marketing head for SE Asia  Disney board nears decision on Josh D’Amaro as next CEO

Disney board nears decision on Josh D’Amaro as next CEO  Experiences, ‘Zootopia2’ help Disney beat earnings estimates

Experiences, ‘Zootopia2’ help Disney beat earnings estimates  No India-Pak cricket match could lead to estimated loss of $250mn

No India-Pak cricket match could lead to estimated loss of $250mn