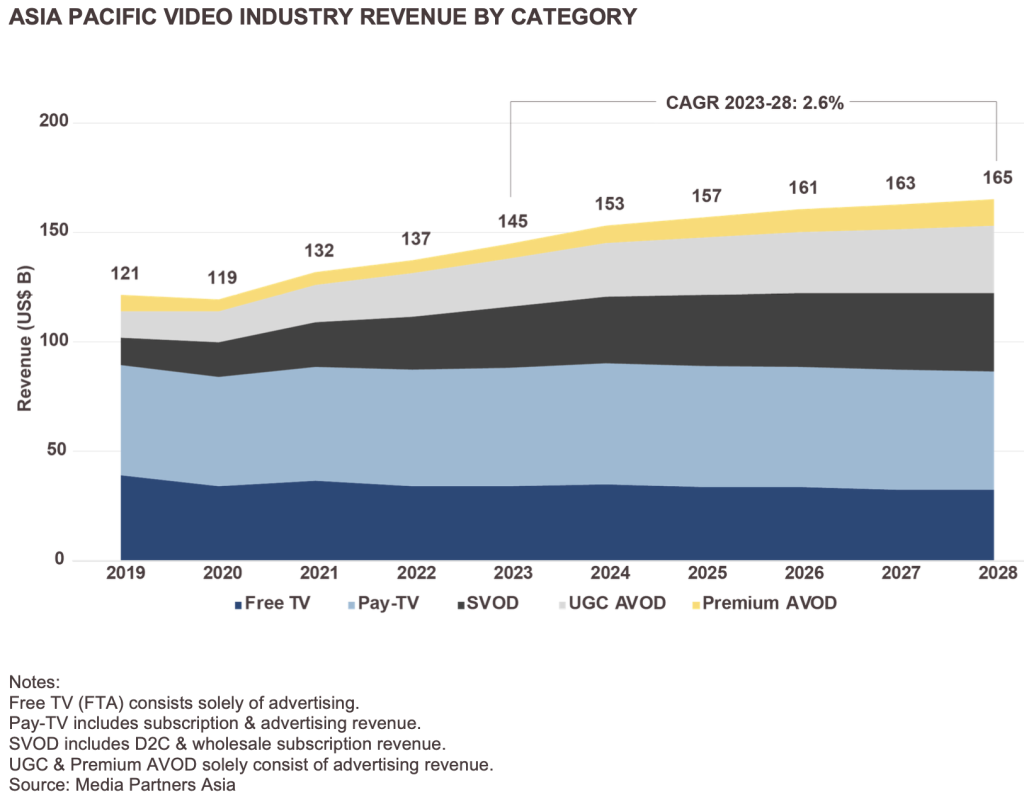

A new set of data released yesterday by Media Partners Asia (MPA) projects that total APAC video industry revenues will grow at a CAGR of 2.6 percent between 2023-28 to reach US$165 billion by 2028 or at a CAGR of 3.3 percent ex-China to US$95 billion.

The APAC online video sector is projected to grow at 6.7 percent CAGR to reach US$78.5 billion in value by 2028 or at 9.2 percent CAGR to US$46 bil. in APAC ex-China, the Singapore-headquartered MPA said.

Pointing out that though China remains the largest and most regulated video market, generating US$64 billion in revenue in 2023, the other top markets markets in 2023 were Japan (US$32 billion), India (US$13 billion), Korea (US$12 billion) and Australia (US$9.5 billion) followed by Taiwan and Indonesia, both at around US$3 billion.

The report, MPA said in a statement, provides a definitive guide to the adoption and monetization of free-to-air TV (free TV), pay-TV, SVOD, premium AVOD and UGC/Social Video advertising in 14 Asia Pacific markets.

Advertising contributed 51 percent to online video revenues in 2023 and its contribution is projected to grow to 54 percent by 2028 and to 63 percent in APAC ex-China (vs 58 percent in 2023).

The six largest revenue generating video industry markets by 2028 will be China, Japan, India, Korea, Australia andIndonesia, with all contributing an aggregate 90 percent to the Asia Pacific total.

The fastest growing markets over 2023-28 in terms of percentage CAGR will be Indonesia (7.3 percent), Philippines (6.2 percent), India (5.6 percent), Vietnam (4.6 percent) and Thailand (4.2 percent).

Commenting on the findings of the report, MPA Managing & Executive Director Vivek Couto said: “The Asia Pacific video industry continues to experience a secular shift from TV to online in terms of engagement and monetization. Improved connectivity, rising connected TV (CTV) penetration combined with the growth of local creator economies, investment in premium local content as well as the wide availability of premium sports streaming, will continue to drive dollars and eyeballs online.

“Clear beneficiaries in the digital video economy include global and local technology and media companies investing in product and content with consumers at the forefront of their strategies.

“According to MPA, 8 companies had an aggregate 65 percent share of the APAC online video revenue pie in 2023: Amazon Prime Video, ByteDance (including TikTok), Disney, Google-owned YouTube, iQIYI, Meta (video), Netflix and Tencent. Ex-China, certain local players are competing successfully and have scale potential, including Jio Cinema and Zee-Sony in India; Foxtel’s Kayo and Nine’s SVOD and BVOD platforms in Australia; TVer and U-Next in Japan; Tving in Korea; Vidio in Indonesia; and Viu across Southeast Asia.”

2023 in Numbers

The APAC video industry grew by 5.5 percent in 2023 as total revenue reached approximately US$145 billion, according to MPA estimates. The 2023 performance was driven by a 13 percent growth in online video sector sales to US$57 billion, partially offset by less than 1 percent growth in the TV revenue pie to US$98 billion.

Excluding China, the APAC video industry grew by 3.2 percent in 2023 with revenue reaching US$81 billion, driven by a 13 percent increase in online video sales to US$30 billion while TV declined by 2 percent to US$51 billion.

Online SVOD grew 15 percent in 2023 to reach US$28 billion or 12 percent ex-China to US$12 billion while the AVOD pie grew 11 percent to US$29 billion or 13 percent ex-China to US$17 billion. UGC / social video continues to dominate the AVOD category with 80 percent share while premium AVOD had 20 percent share in 2023.

Pay TV subscription fees showed marginally below flat growth in APAC ex-China with revenue declines in important markets such as India and Japan while almost every market in Southeast Asia contracted.

Pay TV advertising grew in India but was decimated in Korea. Free TV advertising was down 2 percent in 2023 across APAC ex-China with significant declines in Australia, Indonesia and Korea.

Industry Forecasts

MPA projections indicate that total APAC video industry revenues will grow at a CAGR of 2.6 percent between 2023-28 to top US$165 billion by 2028 or at a CAGR of 3.3 percent ex-China to top US$95 billion.

China will be increasingly mature and grow at 1.7 percent to reach US$70 billion by 2028, followed by Japan (US$35 billion), India (US$17 billion), Korea (US$14 billion), Australia (US$11 billion) and Indonesia (close to US$4 billion).

The APAC online video sector is projected to grow at 6.7 percent CAGR to reach US$78.5 billion in value by 2028 or 9.2 percent ex-China to reach US$46 billion by 2028.

TV industry revenues, including advertising and subscription, will marginally contract at -0.4 percent CAGR between 2023-28 to reach US$86.5 billion by 2028 or at -1 percent CAGR to US$49 billion ex-China.

Scaled TV markets that are expected to still grow but at a much smaller pace include India, Japan, Korea and Indonesia. There remain significant downside risks on TV advertising in Indonesia, India and Korea.

Couto added that new investments made by strategics and private equity in the online video sector in China, India, Indonesia, Japan, Korea and Southeast Asia are helping local and regional companies compete.

“The online video sector is also starting to rationalize with price increases in the SVOD category along with disciplined content and marketing investment, the introduction of ad tiers, new strategies to drive monetization and the start of local market consolidation in Korea, Japan and India,” he added.

Amidst the shift to online and the growth of CTV, traditional linear TV is under pressure with a number of territories not expected to see a meaningful return of TV ad dollars. Local broadcasters are capitalizing through premium AVOD and in certain cases, SVOD, most notably in Australia, India, Indonesia and Japan, Couto further explained.

Prasar Bharati to launch family-oriented OTT Platform

Prasar Bharati to launch family-oriented OTT Platform  TV upfronts in times of digital video advertising: how relevant?

TV upfronts in times of digital video advertising: how relevant?  Ofcom suggests to UK govt. way forward for TV distribution policies

Ofcom suggests to UK govt. way forward for TV distribution policies  Hulu announces premiere date for ‘Only Murders in the Building’ S4

Hulu announces premiere date for ‘Only Murders in the Building’ S4  PM Modi recalls bond with Varanasi in interview with India Today

PM Modi recalls bond with Varanasi in interview with India Today  Pocket FM announces four superhero audio series

Pocket FM announces four superhero audio series  Vibhu Agarwal announces first mythology OTT platform Hari Om

Vibhu Agarwal announces first mythology OTT platform Hari Om  Praful Akali, Ashish Khazanchi appointed Jury Chairs for Abby Awards 2024

Praful Akali, Ashish Khazanchi appointed Jury Chairs for Abby Awards 2024