US President Donald Trump purchased more than USD 1 million worth of corporate bonds issued by Netflix and Warner Bros. Discovery shortly after the two media giants announced a major merger agreement. The investments were disclosed in a financial filing released by the White House on Friday, shedding light on Trump’s transactions during the final weeks of last year.

According to an ANI report, the disclosure shows that Trump bought between USD 250,001 and USD 500,000 worth of Netflix debt securities on two occasions — December 12 and December 16. On the same dates, he also acquired bonds in the same value range issued by Discovery Communications, a subsidiary of Warner Bros. Discovery. The financial disclosure covers transactions made between mid-November and late December.

The filings released through the US Office of Government Ethics indicate that a significant portion of Trump’s recent investments were directed towards municipal bonds, including those issued by cities, local school districts, utilities and hospitals. However, the documents also reveal investments in corporate bonds from a range of major companies, including SiriusXM, Boeing, General Motors, Macy’s, Occidental Petroleum and Whirlpool.

The timing of the purchases has drawn attention, as they came just days after Netflix and Warner Bros. Discovery finalised their USD 83 billion mega-deal, under which Netflix is set to acquire WBD’s studios and streaming businesses. In December, Trump also met Netflix co-chief executive officer Ted Sarandos at the White House, where discussions reportedly included the Warner Bros. Discovery transaction.

Meanwhile, the deal has sparked further industry intrigue, with Paramount attempting to lure Warner Bros. Discovery away from Netflix through a hostile tender offer and the possibility of a proxy fight. Paramount has publicly claimed that the Netflix deal is inferior in terms of value, timing and certainty of closure.

Paramount has alleged that Netflix’s offer includes USD 23.25 in cash, Netflix shares currently valued at USD 4.11, and equity in a proposed Global Networks business, which Paramount claims has zero equity value. The company has also accused Warner Bros. Discovery of failing to disclose key financial details, including how the Global Networks equity was valued, how the overall Netflix transaction was assessed, and how debt transfers could reduce the final consideration payable to shareholders.

As the high-stakes battle for Warner Bros. Discovery continues to unfold, Trump’s bond purchases have added another layer of interest to an already closely watched media industry consolidation.

FY26 Q3 pay TV viewership dips; telecom subs, revenues up: TRAI

FY26 Q3 pay TV viewership dips; telecom subs, revenues up: TRAI  India’s football body invites commercial rights bids for 15 years

India’s football body invites commercial rights bids for 15 years  NDTV India, NDTV 24×7 lead YouTube viewership amid major news cycle

NDTV India, NDTV 24×7 lead YouTube viewership amid major news cycle  SC judge Nagarathna says media can’t perform under constraint

SC judge Nagarathna says media can’t perform under constraint  JioStar’s Piyush Goyal outlines vision for ‘Any Screen, Any Pipe’ future of TV

JioStar’s Piyush Goyal outlines vision for ‘Any Screen, Any Pipe’ future of TV  ‘Scary Movie’ returns with 6th instalment, set for June release

‘Scary Movie’ returns with 6th instalment, set for June release  WPP Media elevates Dipti Gulati as APMEA VP for Client Growth

WPP Media elevates Dipti Gulati as APMEA VP for Client Growth  Apple TV cancels Kristen Wiig-led comedy ‘Palm Royale’

Apple TV cancels Kristen Wiig-led comedy ‘Palm Royale’  Jio Platforms appoints Dan Bailey as prez to drive global expansion

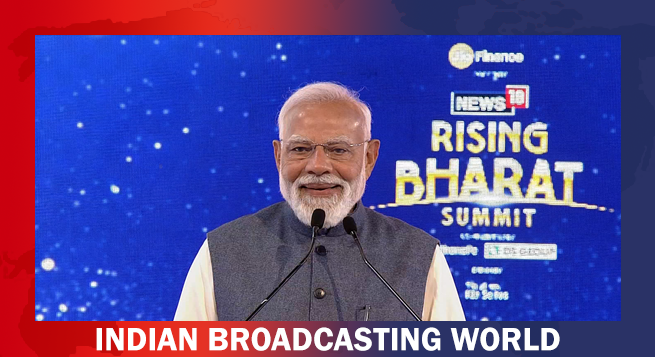

Jio Platforms appoints Dan Bailey as prez to drive global expansion  Rising Bharat ’26: PM outlined vision of self-reliance, AI leadership

Rising Bharat ’26: PM outlined vision of self-reliance, AI leadership