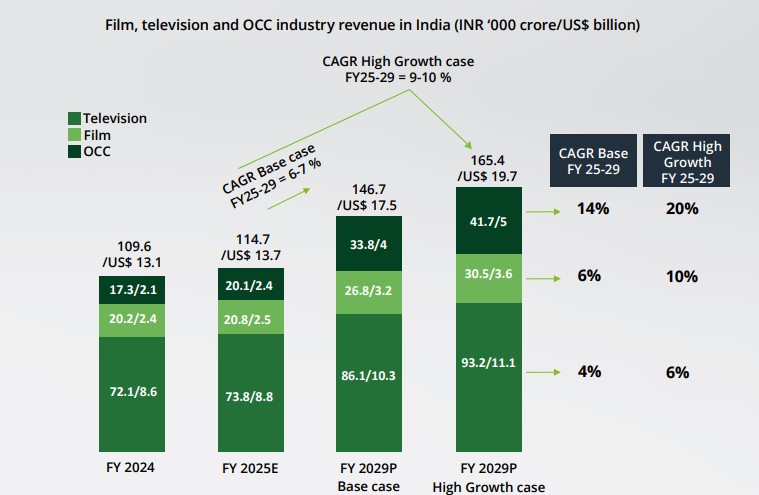

The film, television, and online curated content (OCC) industry in India recorded a combined revenue of approximately Rs.1.1 lakh crore (US$13.1 billion) in FY2024, reflecting a strong 18 percent growth since FY2019. This momentum was achieved despite pandemic-induced challenges such as theatre shutdowns and production halts—underscoring the sector’s underlying resilience and its vital role in India’s entertainment economy.

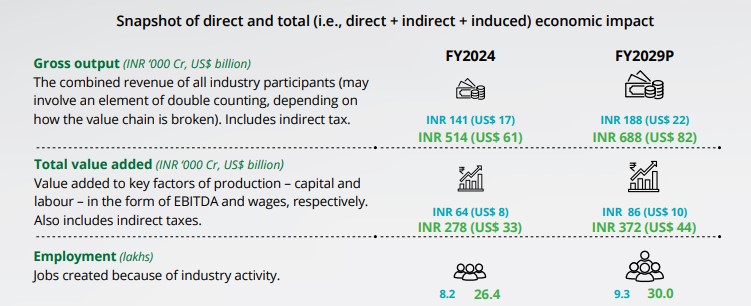

According to a joint report prepared by Deloitte and the Motion Picture Association (MPA) titled “Economic Impact of the Film, Television and Online Curated Content Industry in India,” the industry generated a direct gross output of Rs.1.41 lakh crore (US$16.8 billion) and directly employed 8.2 lakh (0.82 million) individuals in FY2024. When indirect and induced effects are factored in, the total gross output rises to Rs.5.14 lakh crore (US$61.2 billion), supporting an impressive 2.64 million jobs across the value chain.

This vibrant growth is attributed to demographic advantages such as India’s young population and increasing household incomes. As discretionary spending continues to rise, the appetite for diverse entertainment offerings is growing. Notably, in contrast to global trends, traditional linear television in India is still expected to maintain a modest growth trajectory, while the OCC segment expands the overall content landscape rather than disrupt it—at least in the medium term.

In its base-case scenario, the report projects that the industry will grow at a CAGR of 6–7 percent from FY2025 to FY2029, driven by strong demand and content innovation. However, with strategic interventions, this trajectory could accelerate to 9–10 percent CAGR, potentially increasing the industry’s gross output by an additional Rs.1.74 lakh crore (US$20.7 billion) and generating 3.6 lakh new jobs over the next five years.

The report further outlines key areas of economic contribution—capital and labour—reflected through EBITDA and wages, as well as indirect taxes. In FY2024 alone, the industry added Rs.86,000 crore (US$10 billion) in total value, which is projected to rise to Rs.3.72 lakh crore (US$44 billion) by FY2029 under a high-growth scenario.

To realise this potential, the report stresses the need for enablers such as stronger IP protection, incentives for content creators, light-touch regulations, and improved ease of doing business. For instance, streamlining permissions for shooting and allowing theatre screens to open outside malls could significantly boost content distribution. It also calls for ramping up skill development, leveraging India’s cultural soft power, and embracing new technologies and advertising models reshaping the entertainment landscape.

As per projections, while television remains the largest contributor to revenue at Rs.73,800 crore (US$8.8 billion), the OCC and film segments are poised for faster growth. If India capitalises on these opportunities and policy-level changes, it can position itself not only as a consumer hub but also as a global leader in creative content production.

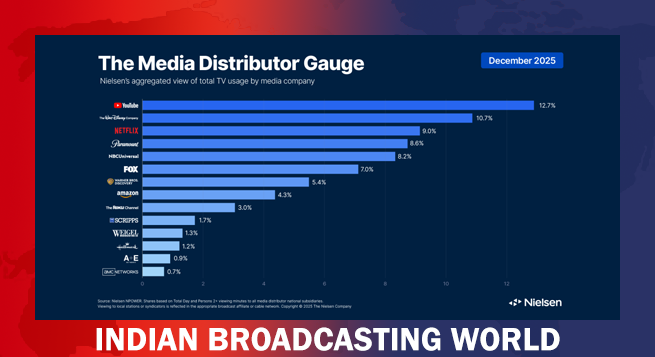

Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Amazon MGM limits press access at Melania Trump documentary screening

Amazon MGM limits press access at Melania Trump documentary screening  Facebook India profit jumps 28% to Rs 647 crore in FY25

Facebook India profit jumps 28% to Rs 647 crore in FY25  Esports Nations Cup 2026 announced with $45 mn commitment from EWCF

Esports Nations Cup 2026 announced with $45 mn commitment from EWCF  Airtel to offer free Adobe Express Premium to 360 mn customers in global first

Airtel to offer free Adobe Express Premium to 360 mn customers in global first  Collective Artists Network welcomes Rawal, Jain, Regulapati as partners

Collective Artists Network welcomes Rawal, Jain, Regulapati as partners