Homegrown advertising agency Crayons Advertising yesterday said it has fixed a price band of Rs 62-65 per share for its initial share sale offering, which will open for public subscription on May 22.

The issue will conclude on May 25 and shares of the company will be listed on NSE Emerge, the company said in a statement.

The company would offer 64.30 lakh equity shares of face value Rs 10 each through the book-building process. At the upper price band of the issue, the advertising firm will raise Rs 41.79 crore, a PTI report stated.

Proceeds of the issue will be utilised for capital expenditure on infrastructure and cutting-edge technology.

Of the total 64.30 lakhs equity share offered, 30.52 lakh shares have been reserved for qualified institutional buyers (QIBs), 9.18 lakh shares for High Net-worth Individuals (HNIs) and 21.38 shares will be provided to the public.

Founded in 1986, Crayons Advertising provides an end-to-end ad-tech communication solutions platform for advertising media services consisting of brand strategy, events, digital media, print media, and outdoor media services.

For the nine months ended December 2022, Crayons Advertising earned a total revenue of Rs 203.75 crore and a net profit of Rs 12.67 crore. Corporate Capital Venture is the lead manager, and Skyline Financial Service is the registrar to the issue.

NHRC notice to MIB as separate petition filed against ‘Ghooskhor Pandat’

NHRC notice to MIB as separate petition filed against ‘Ghooskhor Pandat’  India programming careful blend of art, science: Netflix’s Shergill

India programming careful blend of art, science: Netflix’s Shergill  ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  TV9 Network’s announces Lounge Knights Awards 2026

TV9 Network’s announces Lounge Knights Awards 2026  Regrip clinches Rs.20.25 cr on Amazon MX Player’s ‘Bharat Ke Super Founders’

Regrip clinches Rs.20.25 cr on Amazon MX Player’s ‘Bharat Ke Super Founders’  Balaji Telefilms launches Hoonur talent management arm

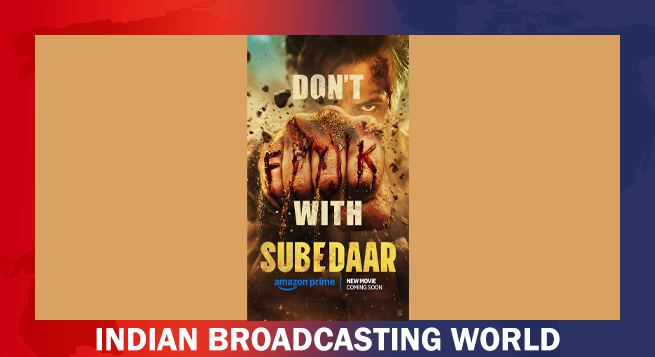

Balaji Telefilms launches Hoonur talent management arm  Prime Video unveils bold first look of ‘Subedaar’

Prime Video unveils bold first look of ‘Subedaar’  hoichoi CEO holds forth on FM radio, other new initiatives

hoichoi CEO holds forth on FM radio, other new initiatives