India’s Zee Entertainment Enterprises said in a stock exchange filing on Sunday that it had sought a further extension of a merger deadline from the Indian arm of Japan’s Sony Group “to make the scheme effective”.

Zee Entertainment said in a separate filing on Saturday that independent board directors Vivek Mehra and Sasha Mirchandani had not gotten the votes needed to secure their re-appointment ahead of a Dec. 21 deadline for completion of the merger, Reuters reported.

The reappointment of the two Zee Entertainment independent directors was being closely watched as they could have influenced the selection of the head of the newly merged entity.

The deal to create a $10 billion media and entertainment powerhouse was first announced two years ago, but has been delayed due to regulatory and other uncertainties.

The two companies have also previously clashed over whose top executive will run the merged entity.

Sony is pushing for its Indian operations managing director N.P. Singh to head the merged company, as Zee’s candidate Punit Goenka was under investigation, the Mint business newspaper reported in November, citing people aware of the matter.

An Indian tribunal lifted a ban in October on Goenka holding board positions in Zee Group companies but said he will have to cooperate with any investigation by India’s markets watchdog.

The Securities and Exchange Board of India (SEBI) had in June alleged that Goenka and Zee Group Chairman Subhash Chandra were actively involved in diverting company funds.

Goenka and Chandra have both denied any wrongdoing.

NHRC notice to MIB as separate petition filed against ‘Ghooskhor Pandat’

NHRC notice to MIB as separate petition filed against ‘Ghooskhor Pandat’  India programming careful blend of art, science: Netflix’s Shergill

India programming careful blend of art, science: Netflix’s Shergill  ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  hoichoi CEO holds forth on FM radio, other new initiatives

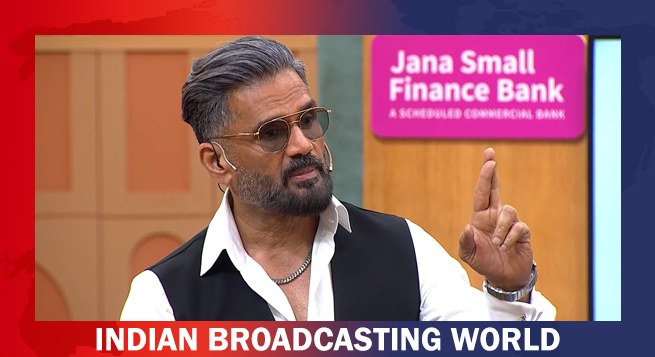

hoichoi CEO holds forth on FM radio, other new initiatives  Suniel Shetty on purpose vs. profits on ‘Bharat Ke Super Founders’

Suniel Shetty on purpose vs. profits on ‘Bharat Ke Super Founders’  TRAI amendments overhaul audit provisions, compliance levels

TRAI amendments overhaul audit provisions, compliance levels  Airtel Q3 profits up on upgraded plans, rise in subs numbers

Airtel Q3 profits up on upgraded plans, rise in subs numbers