Cinema and multiplex operators have urged the government to put film tickets priced below Rs 300 under the lowest 5 per cent slab under the new GST regime.

The move will make cinema viewing more affordable for masses and help the film exhibition industry, which is facing financial difficulties since the pandemic, the Multiplex Association of India (MAI) said, according to a PTI report from New Delhi. Under the current GST regime, cinema tickets that are priced over Rs 100 are put under a GST slab of 18 per cent and below that under 12 per cent.

“We are recommending that the Rs 100 slab be raised to Rs 300, so ticket prices till Rs 300 should attract 5 per cent GST, and anything higher than Rs 300 should attract 18 per cent GST,” MAI President Kamal Gianchandani told PTI.

According to Gianchandani, the slab of Rs 100 is now considered a low number, and this point was represented to the Finance Ministry and the Information and Broadcasting Ministry, but in the last seven and a half years it has not changed.

“Rs 300 slab will make cinema tickets more affordable,” he said, adding that it will also infuse confidence in the exhibition sector as the incumbent players need that boost, in order to accelerate the growth rate. He further said the average ticket price in India is around Rs 170-175.

“… if the government accepts our recommendation of keeping ticket prices below Rs 300 at a 5 percent level, you should expect a reduction of at least… 20-25 odd rupees in the average ticket price,” he said.

MAI, which claims to represent over 9,000 screens, of which 4,000 are multiplex screens and 5,000 single screens, said the cinema exhibition industry is a “fit case” and “ideal mandate” for GST rationalisation.

The food & beverages in cinema halls are treated as “restaurant service without input tax credit (ITC)” and, according to MAI, this blocks credit on inputs like ingredients, packaging, utilities and services.

“All inputs that we purchase from our partners and vendors, we are not able to set off the GST that we pay on it, towards our output GST, so currently there is inefficiency, complexity existing in the GST structure as far as the F&B part of our business is concerned,” he said.

By giving the input tax credit, the GST rate structure will become simpler and compliance will become better than what it is today, he said.

Another media report quoted him as saying, “Our request to the government is that now because we are doing GST reform, the Prime Minister has spoken about rationalising GST rates to improve the affordability across the country, this is a fantastic opportunity to revise the GST rates. Come out with a new GST tax structure for movie tickets…”

“While one rate is always simpler, we (PVR INOX) could handle the complexity because we are a large listed entity. We have the resources to handle the dual GST structure. But the impact of this dual tax structure has been that bulk of our tickets qualify for the 18 percent GST. The Rs 100 GST slab is impractical. Even in 2018, we had requested the then Finance Minister Arun Jaitley to look at a higher number because Rs 100 was impractical in 2018,” the MAI head said.

(The image is only for representation purpose)

Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  SPNI picks up media rights of DP World Tour Golf tourney

SPNI picks up media rights of DP World Tour Golf tourney  BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini

BCCI signs 3-year Rs. 270cr IPL deal with Google Gemini  NDTV Profit rolls out ‘Return on Watching’ campaign ahead of Union Budget 2026

NDTV Profit rolls out ‘Return on Watching’ campaign ahead of Union Budget 2026  ‘Dhurandhar’ set for Netflix debut on January 30

‘Dhurandhar’ set for Netflix debut on January 30  Amazon MX Player announces revenge drama ‘Ab Hoga Hisaab’

Amazon MX Player announces revenge drama ‘Ab Hoga Hisaab’  MTV Splitsvilla X6 returns with star-studded sponsor lineup

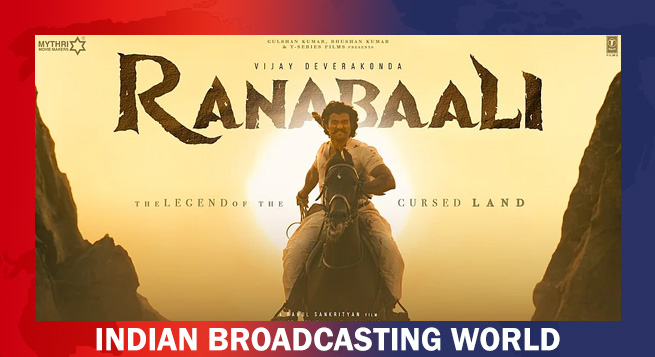

MTV Splitsvilla X6 returns with star-studded sponsor lineup  Vijay Deverakonda, Rashmika Mandanna gear up for period drama ‘Ranabaali’

Vijay Deverakonda, Rashmika Mandanna gear up for period drama ‘Ranabaali’