As India inches closer to achieving the landmark of $1 trillion in Assets Under Management (AUM), the country’s mutual fund industry gathered in full strength at the fourth edition of the Moneycontrol Mutual Fund Summit held in Mumbai. The high-powered event brought together an influential lineup of regulators, fund managers, market experts and distributors to collectively define the roadmap for the next trillion—anchored in growth that is responsible, inclusive and investor-first.

According to an press release, the summit, held in a packed auditorium, became a key platform for dialogue around the role mutual funds play in wealth creation and financial empowerment. Keynote speaker Amarjeet Singh, Whole-Time Member of SEBI, reminded the gathering that while India has made giant strides in the mutual fund space, the journey ahead demands greater responsibility and ethical conduct from all stakeholders. “Growing the right and responsible way becomes very important,” Singh emphasized. “People are trusting mutual funds with their money, and that trust is very important—it should not be disturbed.”

Navneet Munot, Managing Director and CEO of HDFC AMC, echoed similar sentiments, calling for the industry to remain anchored in values and integrity. “Truth is the foundation, transparency is the path, and True North can be like our compass,” he said, appreciating SEBI’s co-creative approach to regulation which, he noted, fosters innovation while protecting investors’ interests.

Offering a global perspective, Ashish Gupta, Chief Investment Officer at Axis AMC, pointed to geopolitical uncertainty and macroeconomic risks that continue to impact all markets. “If I look at the sum total of risk—whether on trade or geopolitics—the whole world is affected,” he said. Yet, he added, liquidity remains a major driving force across asset classes, offering some cushion amid the volatility.

Investor education emerged as a central theme throughout the summit. Radhika Gupta, MD & CEO of Edelweiss AMC, stressed the need to simplify the investment journey for individuals. “We’ve created many pieces like Lego. What’s missing is education. We need to tell people kaunsa mutual fund sahi hai—which one fits their goals,” she said. Gupta also praised SEBI’s approval of Social Impact Funds, calling it a progressive step that signals the future of impact-driven investing.

D P Singh, Deputy MD and Joint CEO of SBI Mutual Fund, highlighted the active efforts being made to bridge this knowledge gap. He spoke of platforms like mutualfundskysahi.com, which aim to demystify mutual funds for everyday investors.

Speaking on market penetration, Nilesh Shah, MD of Kotak AMC, underlined a striking contrast: “India has 30 crore vehicle owners but only 5.5 crore mutual fund investors. The next leg of growth lies in smaller towns and newer investors.” Shah’s comment underscored the vast untapped potential that lies beyond the metros, waiting to be included in India’s financial growth story.

The day-long summit featured in-depth sessions on macroeconomic risks, regulatory frameworks, thematic fund strategies, and technology-led innovations. The consensus across panels was clear: while innovation must be encouraged, it must never come at the cost of transparency, investor trust, or long-term sustainability.

As India’s mutual fund industry marches toward the $1 trillion mark, the summit served as a crucial reminder—growth is not just about numbers but about nurturing a trustworthy ecosystem where every rupee invested finds its rightful value.

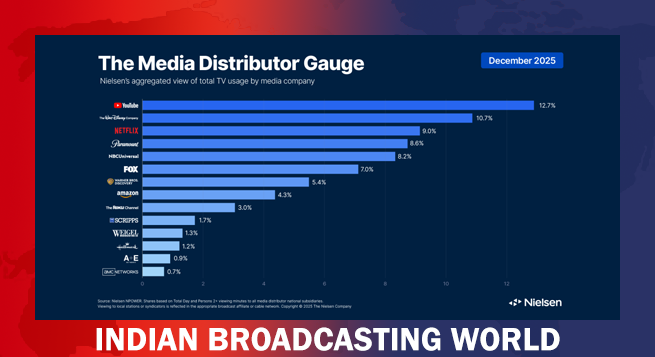

Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  ‘Black Warrant’ star Cheema says initial OTT focus intentional

‘Black Warrant’ star Cheema says initial OTT focus intentional  Cinema, TV different media to entertain audiences: Akshay Kumar

Cinema, TV different media to entertain audiences: Akshay Kumar  Zee Q3 profit down 5.37% on higher costs, lower ad revenues

Zee Q3 profit down 5.37% on higher costs, lower ad revenues  Amazon MGM limits press access at Melania Trump documentary screening

Amazon MGM limits press access at Melania Trump documentary screening  Facebook India profit jumps 28% to Rs 647 crore in FY25

Facebook India profit jumps 28% to Rs 647 crore in FY25  Esports Nations Cup 2026 announced with $45 mn commitment from EWCF

Esports Nations Cup 2026 announced with $45 mn commitment from EWCF  Airtel to offer free Adobe Express Premium to 360 mn customers in global first

Airtel to offer free Adobe Express Premium to 360 mn customers in global first  Collective Artists Network welcomes Rawal, Jain, Regulapati as partners

Collective Artists Network welcomes Rawal, Jain, Regulapati as partners