Media market research firm Media Partners Asia (MPA), which released its flagship report titled ‘Asia-Pacific Video & Broadband 2026’ (AVB 2026) yesterday, said India will overtake China to emerge as the largest market for SVOD subscriptions by 2030 with 358 million individual subscriptions

However, dwelling on the intricacies of pricing and other issues, MPA highlighted that despite growing rapidly, India’s premium VOD revenue pie, including subscriptions and ads, will remain 4.5x smaller than that of China and 2.5x smaller than Japan.

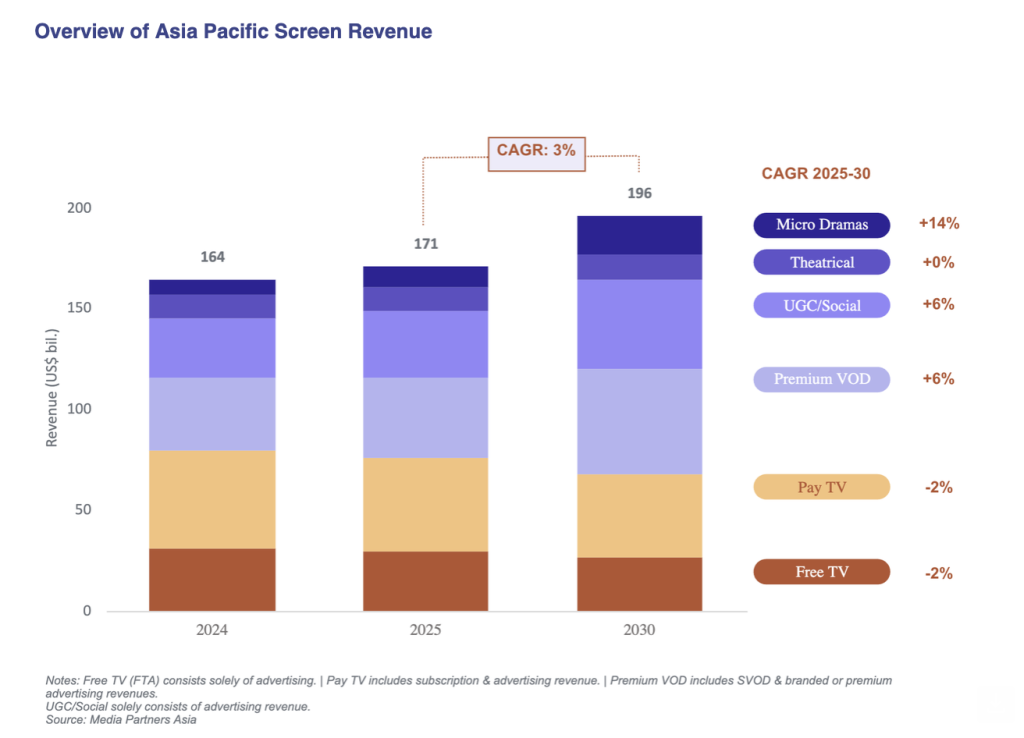

MPA’s flagship annual assessment of the region’s video industry finds that Asia-Pacific total screen revenues will continue to grow through 2030, but that growth is increasingly concentrated in streaming, social video and connected TV (CTV), while traditional television faces sustained structural pressure.

According to data put out by the Singapore-based company, between 2025 and 2030, the premium video on demand (premium VOD) category, including subscription video on demand (SVOD) and branded or premium advertising-supported video on demand (premium AVOD), is forecast to add approximately US$12.5 billion in incremental growth revenue, reaching US$52 billion by the end of the decade.

Over the same period, user-generated and social video revenues are projected to expand by US$11.4 billion to US$44.5 billion, making creator-led platforms the single largest growth engine across the Asia-Pacific screen economy. In contrast, traditional television revenues are projected to decline by a cumulative US$8.0 billion, reflecting ongoing weakness in linear advertising and pay TV subscriptions.

Commenting on the findings of the report, Vivek Couto, CEO and Executive Director of Media Partners Asia, said: “Value is shifting decisively toward streaming, social platforms and CTV-led monetisation. Markets with scale, pricing power and strong local content ecosystems will continue to outperform, while traditional television economics face long-term structural erosion.

“What differentiates winners in this cycle is not volume alone, but the ability to monetise premium experiences, anchored by sports, high-quality local programming, emerging formats such as micro-dramas, and increasingly by AI-enabled efficiency across the content value chain.”

Some of the key highlights of the reports are the following:

# Asia-Pacific screen industry revenues expand at a 2.8 percent CAGR between 2025–30 to top US$196 billion, with all net growth generated by online video, which will increase at 7 percent CAGR over the forecast period.

# The premium VOD category will be more than US$12.5 billion in growth revenue between 2025 and 2030, led by Japan, China and India, followed by Australia, Korea and Indonesia.

# User-generated and social video revenues grew by US$11.4 billion, driven by advertising and expanding CTV inventory with China, Japan, India and Australia leading the way.

# Traditional television revenues decline by US$8.0 billion, with China, Japan and India accounting for nearly 70 percent of the contraction, while Australia and Korea will contribute more than 15 percent combined to the decline.

# The top 15 online video platforms accounted for 58 percent of total online video revenues in 2025, underscoring rising concentration, led by YouTube, ByteDance’s Douyin and TikTok and Netflix, alongside strong national champions such as JioHotstar and U-NEXT.

Some of the key themes and trends identified by AVB 2026 are the following:

# AVB 2026 identifies Japan and India as the two largest contributors to incremental video and streaming revenue growth ex-China. In Japan, growth is ARPU-led, supported by higher-priced tiers, premium local content, sports-led differentiation and advanced AVOD adoption. India’s growth remains more volume-led but is increasingly supported by monetisation upgrades, advertising-supported offerings, ARPU increases after 2026, and expanding CTV usage.

# CTV has emerged as a structural driver of value creation across the region. MPA estimates that CTV households across Asia-Pacific now number close to 160 million ex-China, and are expected to add nearly 100 million more by 2030, with the largest bases in Japan, India, Korea, Indonesia, Thailand, the Philippines and Australia. The shift to big-screen viewing is materially improving engagement, pricing power and advertising yields.

# User-generated and social video platforms remain the major beneficiaries of online video advertising growth. Outside China, YouTube, Meta and ByteDance (TikTok) account for the majority of incremental spend, while in China the market is led by Douyin, Kuaishou and Tencent. Short-form platforms are also evolving toward episodic consumption, with micro-dramas emerging as a measurable revenue category in China and expected to gain relevance in India, Indonesia, Japan and Thailand.

# As household penetration matures in Australia, Japan and Korea, premium video growth is increasingly pricing and ARPU-led. Platforms across Asia-Pacific are raising prices, introducing higher-tier products and bundling premium sports and local content. Premium AVOD revenues are projected to grow from US$8 billion in 2025 to over US$12 billion by 2030, led by India, Japan and Australia, followed by Korea and Indonesia.

- AI-enabled tools are being deployed across content development, localisation, post-production and marketing, reducing unit costs and accelerating production timelines. This dynamic will reinforce scale advantages and favours platforms with large libraries and diversified monetisation.

Asia-Pacific Video & Broadband 2026 (AVB 2026) is Media Partners Asia’s flagship annual research report and database, providing a comprehensive, data-driven assessment of streaming, user-generated and social video, free-to-air TV, pay TV, connectivity (mobile and fixed broadband) and theatrical exhibition across 14 Asia-Pacific markets with detailed insights and analysis.

Netflix India marks 10 years; Shergill reflects on storytelling journey

Netflix India marks 10 years; Shergill reflects on storytelling journey  Delhi HC restrains 160+ websites from illegal content streaming

Delhi HC restrains 160+ websites from illegal content streaming  Bangladesh bans IPL b’cast in retaliation to Mustafizur matter

Bangladesh bans IPL b’cast in retaliation to Mustafizur matter  Mustafizur IPL impact: Bangladesh no to play T20 WC games in India

Mustafizur IPL impact: Bangladesh no to play T20 WC games in India  WBD rejects revised Paramount bid as risky leveraged buyout

WBD rejects revised Paramount bid as risky leveraged buyout  Spotify eases ways for video creators to earn, unveils new LA studio

Spotify eases ways for video creators to earn, unveils new LA studio  ‘Dhurandhar’ becomes highest-grossing Hindi film, crosses Rs.831 crore nett

‘Dhurandhar’ becomes highest-grossing Hindi film, crosses Rs.831 crore nett  Samantha Ruth Prabhu unveils fierce first look from ‘Maa Inti Bangaram’

Samantha Ruth Prabhu unveils fierce first look from ‘Maa Inti Bangaram’  Truecaller appoints Vikas Khanna as India Sr. Director Ad Sales

Truecaller appoints Vikas Khanna as India Sr. Director Ad Sales