The GST Council will decide on modalities for implementing a 28 per cent Goods and Services Tax on online gaming, casino and horse racing at its next meeting on August 2, sources said.

In its 50th meeting earlier this month, a PTI report from New Delhi stated, the Council headed by Finance Minister Nirmala Sitharaman decided to levy the maximum 28 per cent tax on the full face value of bets in online gaming, casinos and horse racing.

The council representing finance ministers of states will take a final call on whether the tax will be levied on entry-level or on each bet, sources said.

The decision of the Council evoked criticism from the online gaming industry. Following this, Minister of State for Electronics and IT Rajeev Chandrasekhar said that the GST Council should reconsider its decision.

“We are still in the early stages of developing a sustainable and permissible online gaming framework. Once this framework is established, we will approach the GST Council and request their reconsideration based on the new regulatory guidelines,” Chandrasekhar had said.

Giving details of the decisions taken at the 50th Council meeting, Finance Minister Nirmala Sitharaman had said the decision to levy maximum tax on online gaming and casinos was not intended to kill the industry but considering the “moral question” that it cannot be taxed at par with essential commodities.

“We are purely looking at that what is being taxed because it creates value, profit is being made… Based on the wager people win. Today’s decision looks at what is to be taxed and what not,” Sitharaman had said, adding that the IT ministry is looking at the regulatory aspect of online gaming, while the GST Council has taken the decision solely for tax purposes.

The tax on online gaming companies would be imposed without making any differentiation based on whether the games required skill or were based on chance.

An amendment to the GST law to define online gaming, horse racing and casinos as ‘actionable claim’, like lottery and gambling, is likely in the ensuing monsoon session of Parliament.

A group of ministers (GoM) on taxation of online gaming, casinos and horse racing on whether to impose a 28 per cent GST on the face value of bets, or gross gaming revenue (platform fees) had submitted its report to the government in December last year.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

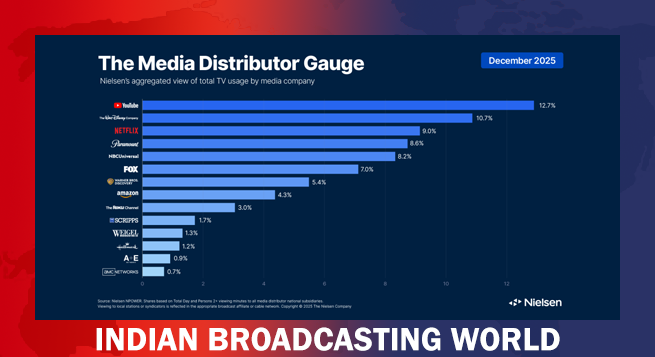

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  WBD extends till ’30 FIA WEC, Le Mans’ India, Europe rights

WBD extends till ’30 FIA WEC, Le Mans’ India, Europe rights  Disney names Josh D’Amaro as new CEO; Dana Walden to be CCO

Disney names Josh D’Amaro as new CEO; Dana Walden to be CCO  SC hauls up Meta, WhatsApp over Indian users’ data

SC hauls up Meta, WhatsApp over Indian users’ data  Netflix India unveils 2026 content slate featuring top stars, new seasons

Netflix India unveils 2026 content slate featuring top stars, new seasons