Warner Bros Discovery yesterday rejected Paramount Skydance’s latest $30-a-share hostile bid, but gave the Hollywood studio seven days to come up with a “best and final” offer for the owner of HBO Max and the ‘Harry Potter’ franchise. Paramount informally broached an even higher per-share price of $31, Warner Bros said, apparently enticing the Board to the table.

But its response to Paramount indicates that Warner Bros prefers the Netflix deal, and the odds of a switch are long. Paramount has until February 23 to make a new offer, which Netflix is allowed to match under the terms of the merger agreement, Warner Bros said, according to a Reuters report yesterday.

“Our Board has not determined that your proposal is reasonably likely to result in a transaction that is superior to the Netflix merger,” Warner Bros Chairman Samuel DiPiazza Jr. and CEO David Zaslav said in a letter sent to the Paramount board on Tuesday (Feb. 17), “We continue to recommend and remain fully committed to our transaction with Netflix.”

The two media giants have been vying for control of Warner Bros, its flagship film and TV studios and deep content library, in a contest that highlights the high stakes of a rapidly shifting entertainment landscape.

A successful deal will give the suitor ownership of Warner Bros’ extensive film and television library, which includes classics ranging from ‘Casablanca’ and ‘Citizen Kane’ to wildly popular favorites like ‘Friends’ and ‘Batman’.

Warner Bros said in its letter it expects a bid above $31 per share, more so because a Paramount financial adviser had orally informed if Warner Bros re-opens deal talks, Paramount would agree to this price, which is not its best offer.

Paramount’s current offer for the whole company comes to $108.4 billion, while Netflix is offering $27.75 a share, or $82.7 billion, just for its studio and streaming businesses.

Warner Bros, which has rejected Paramount’s offers to buy the entire company, is moving forward with a vote on Netflix’s bid on March 20. The merger, if approved, would take place after Warner Bros spins off its Discovery Global cable operations, which include CNN, TLC, Food Network and HGTV, into a separate, publicly traded company.

Discovery Global could fetch between $1.33 per share and $6.86 a share, according to Warner Bros estimates. Warner Bros’ decision to engage with Paramount marks a shift for the studio.

Paramount’s revised offer, which included a personal guarantee on $40 billion in equity from Oracle founder Larry Ellison, father to Paramount CEO David Ellison, was turned down in early January.

The move to open talks with a rival bidder also comes as Warner Bros faces mounting pressure from activist investor Ancora Holdings, which has built a stake in the company and plans to oppose the Netflix transaction.

Paramount is also pressing to add directors to Warner Bros board, eyeing Pentwater Capital Management CEO Matt Halbower as a potential nominee, Halbower said last week. Pentwater, which owns about 50 million shares of Warner Bros, has backed Paramount’s bid.

The deal is also expected to face tough regulatory scrutiny on concerns over price increases for consumers and potential harm for creatives. Paramount and Netflix have said they were engaging with competition authorities across the world, including the US Department of Justice.

Vaishnaw tells global tech, content platforms to follow local rules

Vaishnaw tells global tech, content platforms to follow local rules  Vaishnaw feels AI, creativity will co-exist; strong guardrails needed

Vaishnaw feels AI, creativity will co-exist; strong guardrails needed  India M&E looks for a place under AI sunshine as global meet starts

India M&E looks for a place under AI sunshine as global meet starts  Amazon Ads India head outlines 2026’s 5 brand-consumer connect trends

Amazon Ads India head outlines 2026’s 5 brand-consumer connect trends  UP’s growth roadmap in focus at Times Now Navbharat conclave

UP’s growth roadmap in focus at Times Now Navbharat conclave  ‘Deadloch’ S2 trailer out, Prime Video sets March 20 global premiere

‘Deadloch’ S2 trailer out, Prime Video sets March 20 global premiere  Ofcom, football, police orgs unite in fight against online abuse

Ofcom, football, police orgs unite in fight against online abuse  WBD rejects Paramount latest bid; says open to other offers

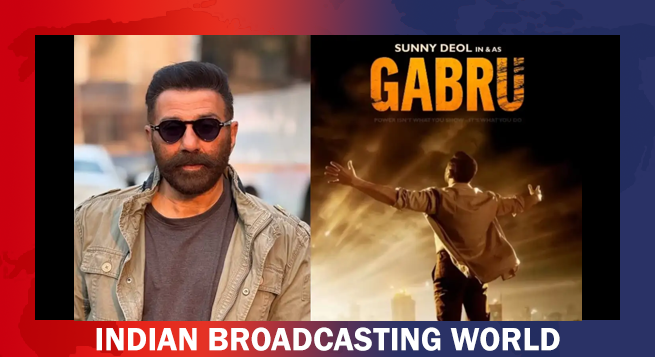

WBD rejects Paramount latest bid; says open to other offers  Sunny Deol’s ‘Gabru’ to release in theatres May 8

Sunny Deol’s ‘Gabru’ to release in theatres May 8