Dish TV India Ltd. has announced its plan to raise Rs 1,000 crore through the issuance of shares and debt.

The decision was made during a recent board meeting where the company also approved the establishment of a wholly owned subsidiary. This new subsidiary will focus on distributing products and services through a digital platform and providing ancillary services, NDTV reported.

The method for raising the capital is yet to be determined. However, the company is considering various options including “issue of equity shares, convertible bonds, debentures, warrants, preference shares, foreign currency convertible bonds, and other equity-linked securities.” These options could be executed through preferential issue on a private placement basis, qualified institutional placement, or other methods, whether listed or unlisted, as stated in an exchange filing.

To proceed with the capital raise, Dish TV has approved a notice of postal ballot to seek shareholder approval. The proposed subsidiary, pending approval from concerned authorities, will have a capital of Rs 10 lakh, which will be fully subscribed under cash consideration towards the company’s share capital.

This strategic move aims to bolster Dish TV‘s financial position and expand its digital distribution capabilities, positioning it for future growth in the competitive market.

ICC warns Pak Cricket Board of legal action against it by JioStar

ICC warns Pak Cricket Board of legal action against it by JioStar  Dream Sports firm FanCode bags ISL global broadcast rights

Dream Sports firm FanCode bags ISL global broadcast rights  Guest Column: Budget’s policy interventions to boost Orange Economy

Guest Column: Budget’s policy interventions to boost Orange Economy  Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups

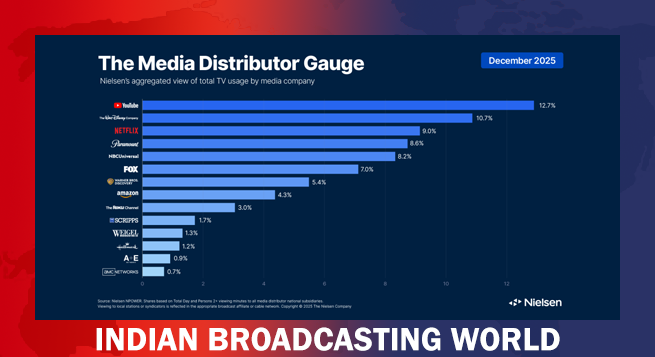

Delhi HC cracks down on illegal streaming during ICC U-19, Men’s T20 World Cups  Holiday Films, Football drive Dec viewership surge: Nielsen

Holiday Films, Football drive Dec viewership surge: Nielsen  WBD extends till ’30 FIA WEC, Le Mans’ India, Europe rights

WBD extends till ’30 FIA WEC, Le Mans’ India, Europe rights  Disney names Josh D’Amaro as new CEO; Dana Walden to be CCO

Disney names Josh D’Amaro as new CEO; Dana Walden to be CCO  SC hauls up Meta, WhatsApp over Indian users’ data

SC hauls up Meta, WhatsApp over Indian users’ data  Netflix India unveils 2026 content slate featuring top stars, new seasons

Netflix India unveils 2026 content slate featuring top stars, new seasons