When it comes to the Supreme Court, it is but natural to be anxious as the avenues of any appeal, after a final order is served, get minimised and are next to impossible. Therefore, the matter of entertainment tax (now subsumed into GST) has become a crucial matter for the MSOs and the LCOs, including the cable TV operators of the country’s capital Delhi. A big question mark has been put over the future of both, and it’s a rare occasion when both have to save their skin.

The tax matter has now landed at the doorstep of the Supreme Court, though earlier the MSOs had cleverly tried to save themselves by shifting the blame on to the cable TV operators in a matter that’s between the MSOs and the Delhi Government.

The apex court has given interim relief to the LCOs by staying the order of Delhi High Court till the case is disposed of. The case got listed on November 29, 2021 in SC, but the hearing could not be done. Now the case has been listed again six weeks later.

Cable TV operators should remember that during the process of migration from analog to digital (DAS) it had been made clear that the responsibility of entertainment tax would be that of the MSO. When the first phase of DAS was implemented from November 1, 2012, in Delhi, Mumbai, Kolkata, and Chennai. There was also a clear instruction regarding the tax — that the entertainment tax would be paid by the cable TV operators till March 31, 2013. And, from April 1, 2013 the responsibility was to be taken up by the MSO.

As the digitalisation movement gained ground, in the early phases both the LCOs and MSOs gave little importance to the tax issue as their attention was focussed more on gaining and retaining customers. DTH platforms’ new and attractive schemes to woo news customers added to the challenges of the LCOs and MSOs. And, the issue of tax and its payment slowly took a backseat as months passed.

Initially, the tax authorities of Delhi also did not give much importance to the fact that tax was not getting deposited by the cable TV stakeholders — till the time outstanding tax amount reached a level that could not be ignored anymore. Eventually, the matter reached the Delhi High Court where the authorities appealed for legal help in realising the tax amount.

But here too the MSOs continued to play tricks and convinced the Delhi court that the LCOs were responsible for this tax impasse. The Delhi HC gave a favourable verdict to the authorities (and the MSOs) on tax realisation from the LCOs. It was then that the cable TV operators woke up from their slumber to knock on the doors of the Supreme Court.

The Supreme Court listened to the cable TV operators point of view and stayed the Delhi High Court order on tax realisation, amounting to crores of rupees, from the LCOs of Delhi.

This was a classic case of a third party being held responsible in the fight between two other parties.

However, while all this was happening, entertainment tax got subsumed into GST; under DAS rates were fixed and TRAI’s new tariff regime was announced, challenged and now is likely to be implemented from April next, apart from other monumental changes like the COVID-19 pandemic.

The pandemic has caused widespread economic losses and many businesses of the cable TV operators shuttered leading to loss of many livelihoods. For many who are still running their businesses, it has become difficult to carry on after the stringent lockdown was gradually lifted. The Delhi HC order had come as a body blow for the cable operators.

It’s to be seen how the cable TV operators prepare for the next round as they scramble for funds to pay for the legal fight with the financially strong MSOs.

So we’d have to wait for the proceedings of the Supreme Court.

Network18 TV news biz revenue up 28% in Q4 FY24

Network18 TV news biz revenue up 28% in Q4 FY24  As Zee gets lean, Punit Goenka in charge of critical verticals

As Zee gets lean, Punit Goenka in charge of critical verticals  60 top ex-cricketers to star in new podcast series ‘180 not out’

60 top ex-cricketers to star in new podcast series ‘180 not out’  Anurag Basu’s ‘Metro… In Dino’ set for November 2024 release

Anurag Basu’s ‘Metro… In Dino’ set for November 2024 release  NBA TV rights talks with Disney, Warner expected to collapse: CNBC

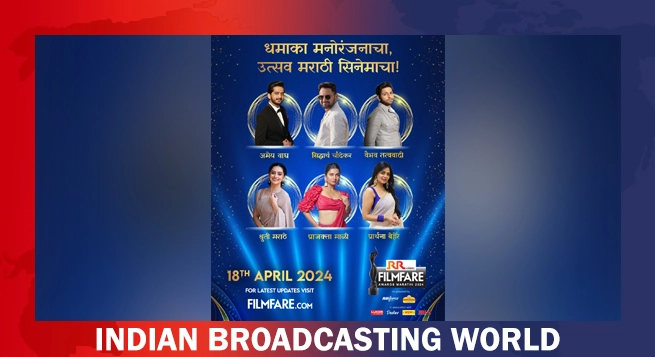

NBA TV rights talks with Disney, Warner expected to collapse: CNBC  RR Kabel Filmfare Awards Marathi 2024 celebrates excellence in Marathi Cinema

RR Kabel Filmfare Awards Marathi 2024 celebrates excellence in Marathi Cinema  Netflix ends subscriber tally reporting

Netflix ends subscriber tally reporting  Goafest 2024, ABBY Awards shift venue to Mumbai

Goafest 2024, ABBY Awards shift venue to Mumbai